Imagine you’re an investor eager to purchase shares of a promising company. You open your trading platform and notice the bid and ask prices for the same stock. The gap between these prices, known as the bid-ask spread, can significantly impact your trading costs and profits. Understanding the bid-ask spread is crucial for navigating financial markets and making informed decisions. In this post, we’ll explore the concept of the bid-ask spread, its influencing factors, examples, and practical tips for navigating bid-ask spreads in your trading journey.

Key Takeaways

The bid-ask spread is the difference between a buyer’s maximum price and a seller’s minimum price for an asset, used as an indicator of liquidity.

The size of bid-ask spreads can be influenced by elements like market volatility, the volume of trading, and the types of orders placed.

Strategies exist to reduce its effects on profits: monitoring liquidity, using limit orders & breaking up trades are essential tips for successful navigation.

Defining the Bid-Ask Spread

Essentially, the bid-ask spread is the gap between the highest price a buyer is prepared to pay for a security (the bid) and the lowest price a seller is willing to accept (the ask).This bid ask spread represents what can be seen as a measure of the liquidity of the asset and the cost of trading it. A wide bid ask spread serves as an indicator of the liquidity of an asset and the cost of trading it. Examples of such securities include stocks, commodities, or currencies.

We’ll examine the components of the current bid price take-ask spread in detail, along with the significant function of market makers.

The Bid Price

The bid price is the maximum amount a buyer is prepared to pay for a security. For instance, this could be a stock’s bid price. In the ever-changing world of financial markets, the stock price, including the stock’s bid price, can fluctuate rapidly. This constant dance of numbers results from the supply and demand dynamics, as buyers and sellers enter or exit the market, affecting the highest or lowest price someone is willing to pay for a security.

The Ask Price

The ask price, also known as the asking price, is the minimum amount a seller is prepared to receive for a security. Factors that can influence the ask price, and consequently the selling price or current market price for financial security, include:

Supply and demand

Market conditions

Company fundamentals

Investor sentiment

As the ask price increases or the stop price decreases, it directly affects the bid-ask spread, indicating a larger or smaller divergence between the buying and selling prices.

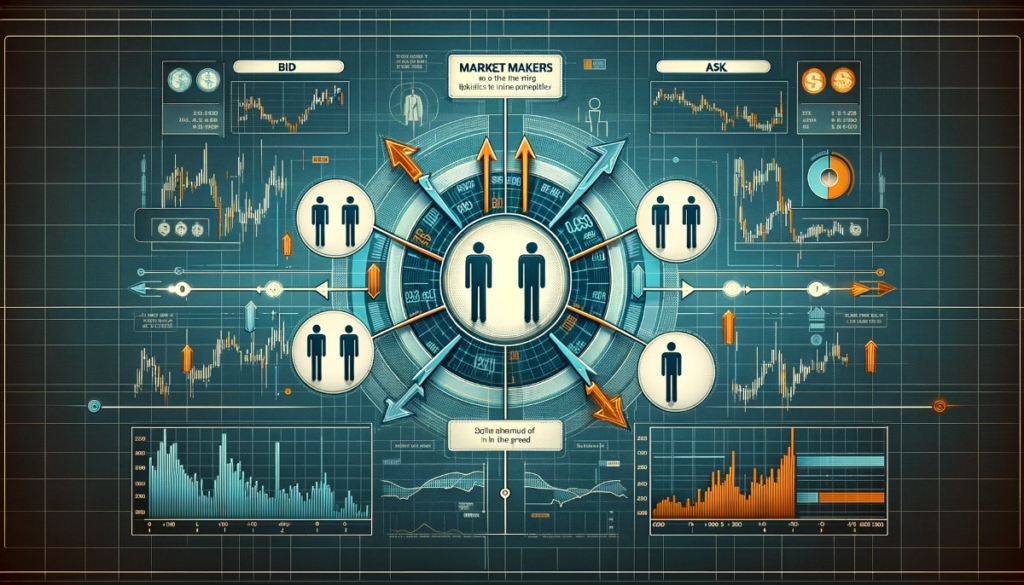

Market Makers’ Role

Market makers, also known as a market maker, play a vital role in facilitating trades by setting bid and ask prices. They assess several factors such as supply and demand dynamics, market conditions, and their own assessment of the security’s value when determining these prices. Additionally, market makers consider transaction costs, risk management, and competition to establish bid and ask prices that ensure their profitability.

To profit from the bid-ask spread, market makers purchase securities at the lower bid price and then sell securities at the higher ask price. By executing multiple transactions daily and capitalizing on the slight price discrepancies between the bid and ask, market makers accumulate profits over time. This process also ensures the smooth functioning of financial markets by providing liquidity and maintaining an orderly market.

Factors Influencing Bid-Ask Spreads

Bid-ask spreads are influenced by various factors, including liquidity, trading volume, and market volatility. Understanding these factors can help investors and traders navigate the bid-ask spread more efficiently.

We’ll investigate how factors such as liquidity, trading volume, and market volatility impact bid-ask spreads.

Liquidity and Trading Volume

Liquidity and trading volume are interconnected, with higher trading volume generally leading to a narrower bid-ask spread, indicating greater liquidity. Liquid assets with high trading volumes, such as large-cap stocks, typically have narrower bid-ask spreads, while illiquid assets with low trading volumes, like small-cap stocks, have wider spreads.

Conversely, lower trading volume can result in a wider bid-ask spread, indicating less liquidity. This can lead to higher transaction costs and difficulty in executing trades at favorable prices. By monitoring liquidity and trading volume, investors can better understand the potential impact of bid-ask spreads lower trading volumes on their trades.

Market Volatility

Market volatility can cause bid-ask spreads to widen as market makers adjust their prices to account for increased risk. During periods of high volatility, market makers face greater risk due to larger price fluctuations and uncertainty, making it more challenging to accurately price securities and maintain an orderly market.

By understanding the relationship between market volatility and bid-ask spreads, investors can better navigate these fluctuations and adjust their trading strategies accordingly.

Bid-Ask Spread Examples

We’ll look at some examples of bid-ask spreads across different trading scenarios. In the stock market, if a trader is looking to acquire 100 shares of Apple at $50, they may observe that 100 shares are being offered at $50.05 in the market. The spread was minimal, only $0.05 between $50.00 and $50.05. Consequently, given point above, the spread was quite tight..

In the currency market, the narrow bid ask spread is even more evident, typically measured in fractions of pennies. Currency is widely considered to be the most liquid asset in the world, resulting in minimal bid-ask spreads. Similarly, metals like gold and silver are known for their narrow bid-ask spreads. In each example, the bid-ask spread reflects the liquidity of the asset and the cost of trading it.

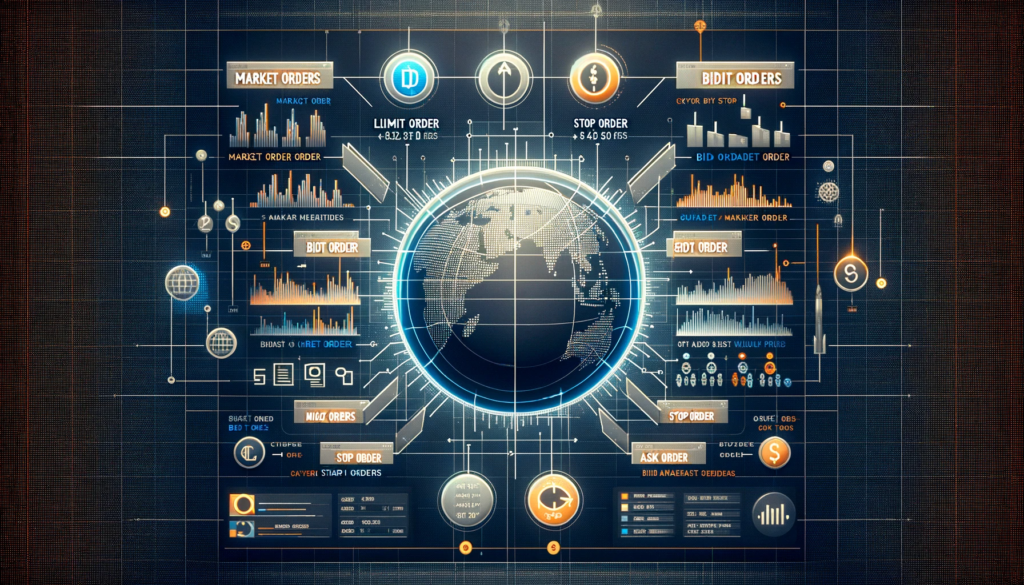

Types of Orders and Bid-Ask Spread

Different types of orders, such as market orders and limit orders, can be used to navigate bid-ask spreads. Market orders are executed promptly at the most advantageous available price in the market, while limit orders are placed with a definite price limit.

We’ll discover how these various order types can influence bid-ask spreads.

Market Orders

Market orders are executed at the best available price but may be subject to a wider spread of bid-ask spreads. When a market order to buy is executed, it will be filled at the ask price, which is usually higher than the bid price. Similarly, when a market order to sell is executed, it will be filled at the bid price, which is normally lower than the ask price.

In scenarios of less supply liquidity and high bid-ask spreads, there are several risks associated with market orders, including:

Increased transaction costs

Slippage

A lack of control over the execution price

Increased volatility

Despite these risks, market orders can be advantageous when the speed of execution is of greater importance than obtaining the best price.

Limit Orders

Limit orders allow investors to:

Set a specific price at which they are willing to buy or sell a security

Potentially reduce the impact of bid-ask spreads

Evade paying the higher ask price or obtaining the lower bid price

Have more control over the execution price

Protect against unfavorable prices

However, there are disadvantages to using limit orders. There is no guarantee that the order will be executed, as the trade will only go through if the market reaches the specified price. Additionally, traders might miss out on potential trades or opportunities if the market moves quickly and surpasses the buy limit order price. In the end, the choice between market and limit orders depends on the trader’s priorities and risk tolerance.

Impact of Bid-Ask Spread on Trading Profits

The bid-ask spread can impact trading profits, particularly for short-term traders, while long-term investors may be less affected. For instance, if an investor purchases a stock at the ask price and then sells it at the bid price, they will incur significant profit or a loss equivalent to the bid-ask spread.

We’ll discuss some strategies for short-term traders and long-term investors to reduce the impact of bid-ask spreads on trading profits.

Short-Term Trading Strategies

Short-term trading strategies may be more sensitive to bid-ask spreads, as frequent trading can result in higher transaction costs. Traders can employ several strategies to reduce the influence of the bid-ask spread on their profits, such as:

Placing limit orders

Observing the bid-ask spread

Breaking up trades

Using alternative trading platforms

By employing these strategies, short-term traders can potentially minimize the impact of bid-ask spreads on their profits and make more informed decisions in volatile markets. This allows them to capitalize on short-term market fluctuations while mitigating the risks associated with wider bid-ask spreads.

Long-Term Investing Considerations

Long-term investors may be less concerned with bid-ask spreads, as they typically hold securities for extended periods and are less affected by short-term price fluctuations. However, it’s still essential for long-term investors to consider the bid-ask spread when making investment decisions, as it can impact their overall returns.

Measures long-term investors can take to reduce the impact of the bid-ask spread on their investments include:

Exercising patience and refraining from frequent trading

Employing limit orders

Evaluating the liquidity of the investment

Diversifying their portfolio

Monitoring bid-ask spreads

By considering these factors, long-term investors can optimize their investment strategies and maximize their returns.

Tips for Navigating Bid-Ask Spreads

As we’ve seen, navigating bid-ask spreads is crucial for both short-term traders and long-term investors. Tips for successfully navigating bid-ask spreads include monitoring liquidity and using limit orders.

We’ll discuss these tips in greater detail.

Monitoring Liquidity

Keeping an eye on the liquidity of a security can help investors gauge the potential impact of bid-ask spreads on their trades. By monitoring liquidity, traders can evaluate the amount of market activity and the ease of executing trades. More specifically, the benefits of monitoring liquidity include:

Evaluating the amount of market activity

Assessing the ease of executing trades

Identifying securities with smaller bid-ask spreads

Signifying tighter pricing and lower transaction costs

To effectively monitor liquidity, investors financial advisors can utilize the following strategies:

Utilize transaction cost measures

Calculate market liquidity ratios

Implement efficient liquidity risk management

Examine historical data and alternative strategies

Adjust measures to incorporate market liquidity risk

Establish a process for monitoring liquidity conditions

Execute suitable liquidity management policies

Utilize liquidity management tools.

Using Limit Orders

Utilizing limit orders can help investors minimize the impact of bid-ask spreads by setting specific buy or sell prices. Limit orders allow traders to set a specific price at which they’re willing to buy or sell a security.By establishing a limit at certain price beforehand, traders can avoid paying the higher ask price or obtaining the lower bid price, thereby narrowing the spread.

Limit orders, such as a limit order, provide more control over higher price than the execution price and can protect against unfavorable prices. However, there is no guarantee that the order will be executed, as the trade will only go through if the market reaches the specified price.

Overall, using limit orders can be a valuable tool for investors looking to minimize the impact of bid-ask spreads on their trades.

Summary

In conclusion, understanding the bid-ask spread is crucial for both short-term traders and long-term investors. By grasping the concept of bid-ask spreads, monitoring liquidity, and utilizing different types of orders, investors can navigate the financial markets more efficiently and maximize their trading profits. Armed with this knowledge, you can make more informed decisions and confidently face the ever-changing landscape of financial markets.

Frequently Asked Questions

Should I buy at the bid or ask price?

It is almost always better to buy stock at the bid price, which is usually a lower price than the ask. However, it is not always possible to buy the stock at this price.

How do you make money from bid-ask spread?

Market makers can generate profits from the bid-ask spread by buying and selling an asset simultaneously. They attempt to generate profits by setting bid prices low enough and ask prices high enough to squeeze out a profit on the trade. Traders can then buy stocks at the bid price and offer them for sale at the ask price, with the difference between two prices becoming their profit.

What happens when bid-ask spread is high?

The bid-ask spread is the difference between the bid price and ask price of a stock and it is an indication of liquidity and market efficiency. A wide bid-ask spread generally means that fewer people are trading a product and it indicates lower levels of supply and demand. Consequently, markets with a wide bid-ask spread are typically less liquid than markets with a narrow spread.

Is a tight bid-ask spread good?

A tight bid-ask spread generally indicates an active security with high liquidity, making it easier to buy or sell at a competitive price. As the spread widens, it may indicate lower liquidity, making it harder and more expensive to trade.

What is the bid-ask spread?

The bid-ask spread signifies the gap between the maximum price a buyer is ready to offer and the minimum price a seller is prepared to receive for a particular price of a financial asset.