We recently published our article Top 5 Best Cybersecurity Micro-Caps to Watch in 2026. This article looks at where Varonis Systems Inc. (NASDAQ:VRNS) fits as cloud and SaaS data security demand rises and investors hunt for sub-$5B cybersecurity winners.

Valuation has quietly reentered the market conversation at a time when many investors least expected it. After several years in which price momentum, thematic investing, and speculative growth dominated headlines, a growing number of market participants are once again screening for cheap stocks and low P/E stocks that trade at meaningful discounts to their underlying earnings power. This shift has not been driven by panic or crisis, but rather by fatigue with stretched valuations and an increasing emphasis on cash flow, balance sheet discipline, and durable business models. In many portfolios, the “multiple you pay” is starting to matter again, especially when the margin for error is thin and investors are demanding proof rather than promises.

What makes this period unusual is that the market is not behaving like a single unified story. Instead, it has become a collection of mini-markets. A small cluster of high-multiple names continues to attract outsized attention, while a much larger portion of the investable universe trades as if growth is permanently capped. That divergence has created a widening lane for undervalued stocks, particularly those with steady earnings, tangible cash generation, and the kind of predictability that tends to regain popularity when investors become more selective.

Why Cheap Stocks Are Showing Up in More Screens Again

Strategists following sector rotation trends have pointed out that valuation dispersion remains unusually wide. Capital has continued to chase a narrow group of high-multiple names tied to emerging technologies and narrative-driven growth, but this has left behind many profitable businesses that are still executing in the real economy. The result is that cheap P/E ratios are no longer limited to distressed companies or structurally broken industries. More frequently, low forward P/E stocks now include firms with recurring revenue streams, stable end markets, or clear capital return policies that have simply fallen out of favor.

This is the type of setup that tends to trigger broader screening behavior. When investors notice that quality companies are trading at discounted multiples, the next step is usually to ask whether the market is mispricing risk or simply ignoring improvement. That question alone is often enough to bring “best cheap stocks to buy right now” back into the research pipeline, especially for managers who need exposure outside the most crowded trades.

The Interest Rate Lens That Keeps Repricing Multiples

Interest rate expectations have played a central role in this dynamic, and they continue to shape how investors interpret valuation. As inflation pressures show signs of moderation and productivity improvements become more visible across the economy, analysts have increasingly discussed the possibility that restrictive monetary policy may not remain in place indefinitely. Even modest shifts in rate expectations can have an outsized impact on valuation models, particularly for companies with steady earnings and predictable cash flows.

When discount rates stabilize or drift lower, the market often becomes more willing to assign higher multiples to cash flows that appear durable. At the same time, when rates remain elevated, investors often prefer stocks that are already priced conservatively. Either way, low forward earnings multiples can act as a buffer, because they require less “multiple expansion” to generate respectable returns. This is one reason forward P/E has become a popular shortcut for identifying cheap stocks, especially when the market is still debating the path of rates.

Sector Rotation Is Quietly Shifting the Hunting Grounds

Sector by sector, this valuation reset has manifested in different ways, and the differences matter. In healthcare, portions of the sector continue to benefit from non-cyclical demand and pricing resilience, yet still trade at earnings multiples more commonly associated with mature or declining industries. In communications and infrastructure-heavy sectors, high capital intensity and regulatory overhangs can weigh on sentiment even when cash generation is steady. In software and digital services, the market’s skepticism around growth normalization can overshadow improving margins and free cash flow conversion. In industrial and consumer-linked sectors, macro uncertainty can mask company-level execution, operational improvement, and shareholder return programs.

What ties these sectors together is not that they are collapsing. It is that their valuations often reflect an assumption that good news will not last or that improvement will not translate into durable earnings. When sectors fall out of favor, the market sometimes prices in a permanent handicap. That is where valuation gaps can form, and where low P/E stocks can begin to stand out again.

Perception Versus Performance Is Creating Price Gaps

What stands out in the current market is how often price movements reflect perception rather than performance. Many companies now classified as cheap stocks have continued to meet or exceed earnings expectations, strengthen balance sheets, and return capital to shareholders, yet their valuations imply limited future upside. This kind of disconnect tends to happen when investors are focused on what could go wrong rather than what has been going right.

Professional investors, especially those with longer time horizons, often treat valuation as a margin of safety rather than a timing tool. When they see durable earnings trading at compressed multiples, the natural question becomes whether the stock is priced for a downturn that may already be reflected in fundamentals, or whether the business is quietly improving while the market remains distracted. This is why forward P/E ratios and earnings durability have become increasingly important screening criteria. They do not guarantee outperformance, but they help narrow the field to companies where expectations appear unusually low relative to current results.

What “Cheap” Actually Means in This Market

In practice, “cheap” does not simply mean low price. It usually means the market is offering an earnings stream at a discounted multiple compared with peers, history, or the broader index. That is why forward earnings multiples tend to be used more than trailing multiples in screening work. Forward P/E is a shorthand for how the market is pricing the next year of expected profitability, and it can reveal where skepticism is embedded.

It also helps explain why cheap stocks often come in clusters. If an entire sector is viewed as out of favor, multiples compress broadly, even for the strongest operators. If a business is executing but the market is still anchored to an older narrative, the valuation may lag. When the story changes faster than the market’s perception, the valuation gap becomes the opportunity.

Why This Leads Naturally to a “Best Cheap Stocks” Shortlist

Against this backdrop, compiling a list of the 5 Best Cheap Stocks to Buy Right Now is less about making bold predictions and more about identifying where valuation, fundamentals, and market expectations are misaligned. These opportunities tend to emerge when sectors fall out of favor not because of structural decline, but because attention has shifted elsewhere. History suggests that such periods often precede meaningful re-rating cycles, especially when broader market conditions begin to stabilize.

This is also why a shortlist approach matters. Not every low multiple stock is undervalued, and not every discounted company is cheap for the right reasons. The goal is to isolate situations where the business has measurable earnings power, credible cash flow generation, and enough visibility for forward expectations to be judged rationally. When those boxes are checked, a low forward multiple becomes more meaningful as a signal rather than a warning.

Setting the Stage for the 5 Best Cheap Stocks to Buy Right Now

In an environment where uncertainty remains elevated but fundamentals continue to assert themselves, cheap stocks with proven earnings power stand out as a distinct segment of the market worth close examination. With valuation once again playing a central role in portfolio construction, the focus naturally turns to identifying which names offer the most compelling combination of low forward multiples, financial resilience, and potential upside if expectations normalize.

That framework sets the stage for reviewing the 5 Best Cheap Stocks to Buy Right Now, a group defined not by hype or narrative momentum, but by the simple reality that the market is still offering some earnings streams at prices that look unusually conservative relative to their fundamentals.

CHECK THIS OUT: Why Governments Are Betting on Secure Chips Instead of Software — SEALSQ Corp (LAES) Explained and Why QuantumScape (QS) Keeps Disappointing Traders but Fascinating Long-Term EV Investors.

Our Framework

To identify the 5 Best Cheap Stocks to Buy Right Now, the analysis focused on publicly traded companies listed in the United States that meet a clear set of quantitative and coverage based criteria. The initial screen required a minimum market capitalization of approximately $2 billion to ensure sufficient liquidity and institutional relevance. Companies were also required to be covered by at least three sell-side analysts, providing a baseline level of market scrutiny and earnings visibility. Finally, the shortlist was narrowed to stocks trading at forward price to earnings multiples below 15x, reflecting a valuation profile that is meaningfully below broader market averages while still supported by ongoing profitability.

YOU MUST READ THIS!!! – 5 Best Cheap Stocks to Buy Right Now

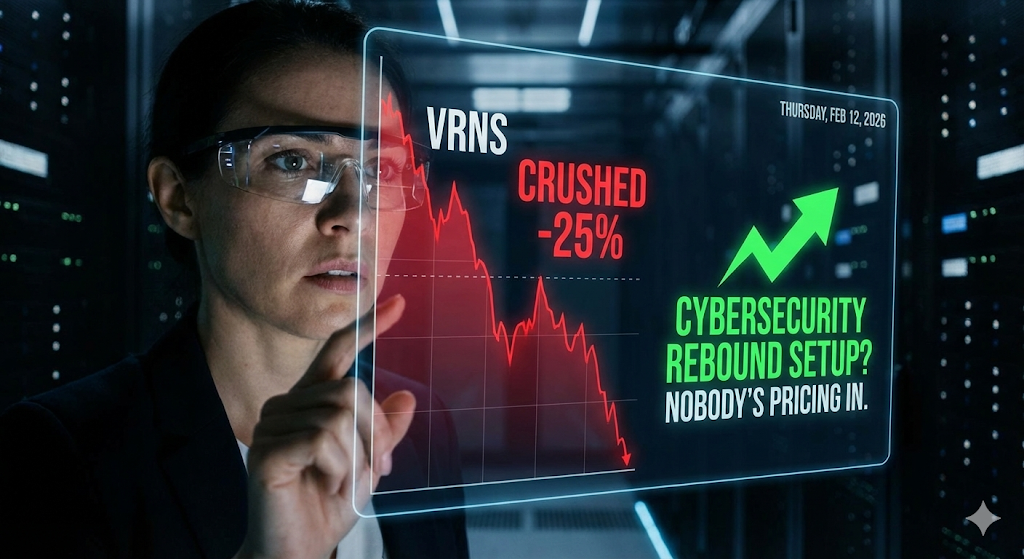

Top 5: Varonis Systems Inc. (NASDAQ:VRNS)

Market Cap: $3 B

A 26% one-month drop and a brutal 12-month slide is exactly the kind of price action that makes impatient shareholders hunt for an exit. Your excerpt captures the core debate: Varonis’ price-to-sales multiple has stayed relatively elevated even as the stock has been punished, which screams “the market is still paying for a future that hasn’t shown up yet.” The bullish thesis starts with a different framing. The selloff is not automatically a verdict that the product is failing; it can also be the market discounting a noisy transition period and near-term margin headwinds while missing the long runway of enterprise data security demand. In cybersecurity, perception can swing faster than fundamentals, especially when a company is mid-pivot, guiding conservatively, and deliberately retooling incentives to prioritize new SaaS ARR rather than “easy” conversion ARR.

The Structural Tailwind: Data Security Is Becoming the Center of Cybersecurity

Cybersecurity spending has historically revolved around endpoints, networks, and identity. But the center of gravity has been shifting toward the data itself, because data is what attackers ultimately monetize, exfiltrate, ransom, or weaponize. That shift accelerates in a world of cloud migration, SaaS sprawl, remote work, and generative AI tools that can read, summarize, move, and even rewrite information at machine speed. In practical SEO language, the problem enterprises are trying to solve is cloud data security, SaaS security, and data governance across environments like Microsoft 365, collaboration apps, and modern cloud storage, where “who has access to what” changes constantly and misconfigurations can quietly build breach conditions over time.

This is where Varonis has lived for years: sensitive data discovery, data classification, least-privilege access remediation, insider threat detection, ransomware detection, and automated response tied to real usage of data. The bullish view is that this category is not a temporary IT project; it’s a permanent layer of modern security architecture. If you believe “zero trust” ultimately means zero implicit trust not only in identity but also in data access pathways, then the addressable need expands over time rather than shrinking.

What Varonis Actually Sells: A Data Security Platform That Can Expand Per Customer

Varonis positions itself as a data security platform designed to continuously discover and classify critical data, remediate exposures, and detect threats with automation and AI. That matters because the buyer’s problem is not just “find sensitive files once.” The ongoing pain is permissions drift, sprawling collaboration surfaces, dormant but still-accessible data, and the reality that breaches often involve legitimate credentials and legitimate tools accessing data in illegitimate ways.

The bull thesis is that platforms win here because enterprises want fewer consoles, fewer point products, and more automation. If Varonis can remain the system of record for “where sensitive data is, who can reach it, and what risky behavior is happening around it,” it becomes a long-lived control point. That control point tends to produce expansion because once you’ve mapped the data, it’s natural to add more coverage (more repositories, more cloud apps), more policy automation (least privilege and exposure remediation), and more detection and response (managed detection, threat hunting, incident workflows). This is the compounding engine that can turn “a good product” into a durable, recurring revenue story.

The Main Catalyst: The SaaS Transition Is Turning Varonis Into a Cleaner Recurring Model

The market’s confusion around Varonis is heavily tied to the mechanics of its SaaS transition. Transitions are messy: reported numbers can be distorted, margins can wobble, and growth comparisons can look worse before they look better. But if the transition succeeds, the business becomes easier to understand and potentially more valuable.

From the company’s most recent reported results for 2025, Varonis delivered $623.5 million in revenue, up 13% year over year. At year-end, it reported total ARR of $745.4 million, up 16% year over year, and SaaS ARR of $638.5 million, which management described as 86% of total ARR. It also disclosed that approximately $65 million of ARR was converted from self-hosted to SaaS in the quarter, leaving roughly $105 million of non-SaaS ARR at period end.

Where the bull case gets interesting is guidance and intentional go-to-market design. Management guided 2026 revenue to $722 million–$730 million (16%–17% growth) and guided total SaaS ARR to $805 million–$840 million (26%–32% growth), while also describing a target to be 100% SaaS by the end of 2026. The company also highlighted SaaS dollar-based net retention at 110% and a subscription customer base of about 6,400, up 14% year over year. That set of data points supports the bullish narrative that Varonis is trying to become a simpler SaaS data security story with durable renewal dynamics and expansion inside accounts. It’s not just “convert old customers.” It’s “convert, then expand, then grow net-new,” and importantly, it is changing incentives so sales reps cannot hit targets by conversions alone and must drive new business and expansion.

Why the Near-Term Looks Ugly: The Transition Has a Real, Guided Headwind

A real bull thesis doesn’t ignore why the stock got hit. Varonis itself guided to a $30 million–$50 million headwind to ARR contribution margin and free cash flow in 2026 tied to the end-of-life transition of the self-hosted platform. That is the kind of sentence that creates a valuation reset, because it tells investors: “even if we’re strategically right, the next year may not look pretty on the cash flow optics.”

It also explains why markets can sell first and ask questions later. Some investors anchor on free cash flow durability, especially in software, and any guided downshift triggers fear that “the business model is weakening.” The bullish counter is that this is a finite transition cost, not necessarily a permanent impairment of unit economics. If the company clears this hump and exits 2026 as a fully SaaS model, the story could become cleaner: less confusion, less bifurcated customer base, and potentially steadier expansion math.

AI, Copilots, and E Strategic Extension: Stopping Attacks Before They Reach the Data

A lot of breaches still begin in the inbox, then later turn into data theft or ransomware. That’s why Varonis has also moved into AI-native email security to help block phishing and social engineering earlier, while connecting identity, email, and data signals for stronger detection and response.

This matters for the bull case because it expands total addressable market and increases platform “stickiness.” If Varonis becomes valuable not only for cloud data security posture management and insider threat detection, but also for preventing the initial compromise path and powering a managed detection-and-response motion around data, then it can compete for a larger share of the security budget. In plain terms, it becomes easier to justify a strategic platform purchase when it covers more of the kill chain: from social engineering attempts to suspicious identity behavior to data access anomalies to automated containment.

The Valuation Debate: A High P/S Multiple Is Either a Warning or a Setup

Your provided excerpt focuses on the P/S ratio and the market’s skepticism. That skepticism isn’t irrational. The way this argument usually goes is simple: if a company’s revenue growth is forecast to be slower than the broader software industry, then a higher-than-industry P/S multiple looks hard to justify without a clear acceleration story. That is exactly why the P/S ratio becomes a sentiment gauge: it tells you whether the market is still pricing in “better days ahead” even when recent performance has disappointed.

The bullish interpretation is that the multiple is not “about last quarter.” It’s a bet on the post-transition business. If Varonis exits 2026 as a fully SaaS data security platform with steady net retention, improving contribution margins after transition headwinds pass, and credible AI governance differentiation, the market may decide it deserves a higher quality multiple despite near-term turbulence.

In other words, the bull case is not that valuation is obviously cheap on a simple ratio today; it’s that the current market mood may be punishing a temporary “transition trough” and extrapolating it too far into the future. If the trough is real but temporary, that’s where asymmetric setups can form.

The Numbers That Support a Long Bull Narrative, Not a Quick Trade

The bullish thesis can be built around a few concrete, disclosed operational facts. The company reported rising ARR and a large SaaS mix, signaling that the recurring revenue base is expanding even during upheaval. It highlighted 110% SaaS dollar-based net retention, suggesting expansion is happening inside existing SaaS accounts. It guided to continued revenue growth in the mid-teens, and to SaaS ARR growth that is materially faster than revenue growth, which usually indicates an expanding future revenue pipeline in SaaS models. It also generated meaningful free cash flow in 2025 and disclosed repurchases, which implies balance-sheet flexibility even as it prepares for transition headwinds.

The bull case is that these metrics describe a company that is still building the base of a recurring platform, not one that is shrinking into irrelevance. The market can punish optics, but ARR and retention are harder to fake over time.

Why This Category Can Re-Accelerate: Data Exposure Is the New Attack Surface

A strong SEO-friendly way to phrase the long-term tailwind is that data exposure is now an attack surface. Modern organizations store sensitive data across cloud storage, SaaS collaboration apps, databases, and a mess of shadow IT repositories. The average business doesn’t just need “security.” It needs continuous sensitive data discovery, automated data classification, least privilege enforcement, and threat detection tuned to how data is accessed. Ransomware groups and insider threats both exploit the same underlying weakness: excessive access and poor visibility over what’s sensitive and where it lives.

Varonis’ approach is designed for this reality. If its platform becomes the default layer for cloud data security posture management, then it isn’t competing only on features; it is competing on being embedded into the workflows that determine what’s safe to access, what’s risky to share, and what gets locked down automatically.

The Real Risk Factors, and Why They Also Define the Upside

The risks are not small, and you can’t build a serious bullish thesis by ignoring them. If the SaaS conversion push causes customer friction, slows new logo acquisition, or compresses margins more than expected, the multiple can compress further. If competitors in data security posture management, data loss prevention, or broader security platforms bundle similar capabilities into bigger suites, Varonis can face pricing pressure. If the enterprise AI security narrative becomes crowded and buyers consolidate into a few suite winners, Varonis must prove it has a right to win beyond its legacy niche.

But those risks are also why the upside can be meaningful if execution is clean. When a company is in a controversial transition, the market often prices the risk as if the worst case is likely. If the company simply performs “not worst case”—stable renewals, consistent SaaS ARR growth, credible AI governance value, and gradual margin recovery after the guided headwind—sentiment can swing sharply because the market’s baseline expectation was too pessimistic.

What Would Prove the Bull Case Over the Next 12–18 Months

For a long-term investor mindset, the proof will likely show up in recurring signals: SaaS ARR growth that holds up even as conversions wind down, improving net retention as the upsell engine strengthens, stable renewal behavior as the customer base becomes purely SaaS, and evidence that enterprise AI security and email security are not just marketing but actually driving pipeline and expansion. Management has explicitly said it expects to end 2026 as 100% SaaS, and it has already disclosed how much non-SaaS ARR remains and how much it expects to convert by year-end, which makes this a measurable execution story rather than a vague promise.

Bottom Line: A Data Security Platform at the Center of Cloud, SaaS, and AI Risk

The long bullish thesis for Varonis is that it is building a category-relevant data security platform for the cloud and AI era at the exact moment enterprises are being forced to get serious about data governance, least privilege, and continuous exposure remediation. The market is punishing the stock because transitions create margin and guidance anxiety, and because valuation optics look demanding when growth is perceived as slower than software peers. But the company’s disclosed ARR base, SaaS mix, retention, customer growth, and clear milestone of becoming fully SaaS by end of 2026 provide a path for the story to improve—especially if enterprise AI security and email security broaden the platform’s relevance and total addressable market.

READ ALSO: The Quiet Semiconductor Disruptor You’ve Never Heard Of: Aeluma Inc (ALMU) and Air Industries Group (AIRI) Narrows Losses to Just $44K — Is This Aerospace Microcap Entering a Turnaround Phase?

Disclosure: No material interests to disclose. This article was originally published on Global Market Bulletin.