Structured to give investors direct access to movements in U.S. natural gas prices without owning physical commodities, this exchange traded fund was created to mirror the daily performance of natural gas delivered at one of the most important pricing hubs in the world. Designed as a commodity-based investment vehicle rather than an operating company, the fund was launched to address growing demand from traders and investors seeking transparent, exchange-listed exposure to natural gas through standardized futures contracts. From its inception, the vehicle has been closely tied to the dynamics of the New York Mercantile Exchange, where natural gas futures are actively traded and priced based on supply, demand, storage, and weather-driven market conditions.

United States Natural Gas Fund (NYSE:UNG) was established by United States Commodity Funds LLC, a firm known for creating commodity-focused exchange traded products that track futures-based benchmarks. The fund trades on NYSE Arca under the ticker UNG and is legally structured as a limited partnership, distinguishing it from traditional equity ETFs. Its core objective is to reflect, in percentage terms, the daily changes in the price of natural gas as measured by the near month futures contract traded on the New York Mercantile Exchange, commonly referred to as NYMEX. These futures contracts are settled based on natural gas delivered at Henry Hub in Louisiana, which serves as the primary benchmark for U.S. natural gas pricing.

Since its launch, the United States Natural Gas Fund has relied on a systematic investment process centered on futures contracts rather than physical storage or delivery. The fund typically holds positions in near month contracts and, as expiration approaches, rolls its exposure into the next available month contract. This rolling process is fundamental to the fund’s design and has shaped its historical performance, particularly during periods of contango or backwardation in the natural gas futures curve. In addition to futures contracts, the fund may use swap contracts, forward agreements, and cash equivalents to maintain exposure and manage liquidity, ensuring it can meet margin requirements and daily trading activity.

The background of UNG is closely linked to the evolution of commodity investing in public markets. Prior to the widespread adoption of exchange traded funds, access to commodities like natural gas was largely limited to professional traders operating directly in futures markets. The United States Natural Gas Fund helped broaden access by allowing investors to buy and sell shares on a regulated exchange during normal market hours, using standard brokerage accounts. This accessibility made the fund a popular tool for short-term trading, hedging strategies, and tactical exposure to natural gas price movements.

Over the years, the fund has become one of the most widely recognized natural gas exchange traded products in the United States. Its price movements are closely watched by traders, analysts, and investors seeking insight into broader trends in commodities, energy markets, and macroeconomic conditions. Because the fund’s net asset value is driven by futures prices rather than corporate earnings or dividends, UNG’s background is inseparable from the structural characteristics of the natural gas market itself, including seasonal demand patterns, weather variability, storage levels, and production trends across major shale basins.

Another defining feature of the United States Natural Gas Fund’s background is its cost structure. The fund charges an expense ratio, historically around 1.11%, which covers management fees, operational expenses, and the costs associated with maintaining futures positions. While this expense ratio is higher than that of many equity ETFs, it reflects the complexity of managing commodity futures exposure and has long been considered an important factor for investors evaluating the fund’s suitability for different time horizons.

Throughout multiple commodity cycles, UNG has remained closely aligned with developments at Henry Hub and on the NYMEX, reacting swiftly to changes in weather forecasts, inventory reports, production data, and global energy trends. Its role has evolved alongside the growth of U.S. shale production, the expansion of liquefied natural gas exports, and shifting global demand for natural gas. Despite periods of volatility and tracking challenges inherent to futures-based funds, the United States Natural Gas Fund has maintained its position as a central reference point for investors seeking real-time exposure to U.S. natural gas prices.

Today, the background of UNG reflects both its original mission and the changing landscape of energy markets. It remains a purpose-built exchange traded fund designed to track natural gas prices through futures contracts, offering investors a liquid and transparent way to engage with one of the most actively traded commodities in the world. Its history is defined not by corporate growth or product sales, but by its consistent role as a financial instrument tied directly to the price behavior of U.S. natural gas.

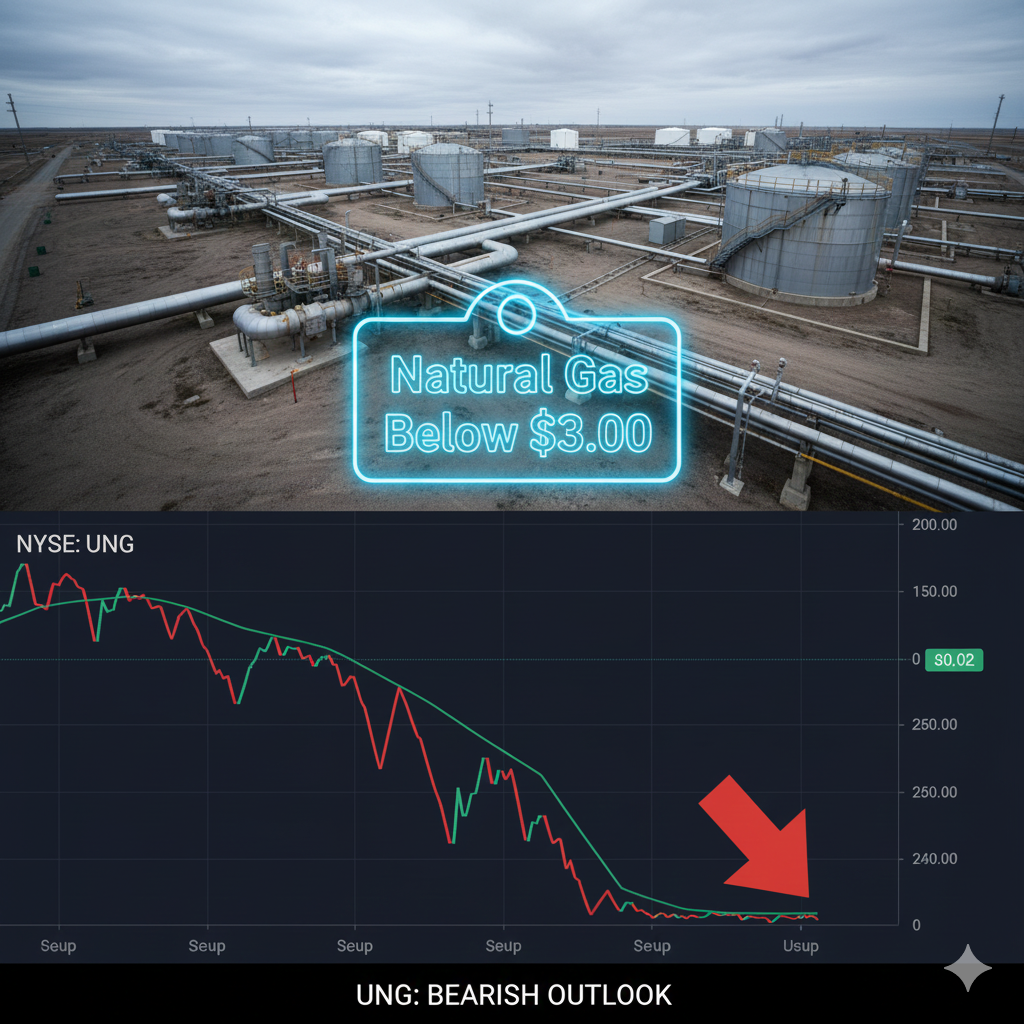

United States Natural Gas Fund Faces Persistent Price Weakness as Structural Forces Begin to Shift

The United States Natural Gas Fund has remained at the center of investor attention as U.S. natural gas prices continue to diverge sharply from international benchmarks, creating a complex backdrop for commodity-linked exchange traded funds. Traded on NYSE Arca under the ticker UNG, the exchange traded fund is designed to provide investors with exposure to natural gas delivered at the Henry Hub in Louisiana, primarily through near month futures contracts traded on the New York Mercantile Exchange, also known as NYMEX. In percentage terms, recent performance has reflected the prolonged softness in U.S. natural gas prices, even as deeper supply-and-demand dynamics suggest that the current market conditions may not be sustainable over the medium to long term.

United States Natural Gas Fund is issued by United States Commodity Funds LLC and structured as a commodity pool rather than a traditional operating company. The fund seeks to track daily changes, in percentage terms, of natural gas prices as measured by its benchmark, which is based on the performance of the near month contract for natural gas futures. These futures contracts are standardized agreements traded on the New York Mercantile Exchange for natural gas delivered at Henry Hub, the most important pricing point in the U.S. gas market. As contracts approach expiration, the fund systematically sells positions nearing expiration and buys the next month contract, a process that directly influences tracking performance during periods of contango or backwardation.

CHECK THIS OUT: Why Nebius (NBIS) Could Outperform CoreWeave & Dominate the $9B AI Infrastructure Market and Is Lucid Group (LCID) Running Out of Cash? $875M Note Deal Raises Alarms.

How UNG Is Structured and Why the Expense Ratio Matters

The United States Natural Gas Fund LP does not hold physical natural gas. Instead, it gains exposure through futures contracts, swap contracts, forwards, and cash equivalents. This structure makes UNG highly sensitive to the shape of the futures curve. When near month contracts trade below longer-dated contracts, a condition known as contango, the fund can experience roll yield losses that cause tracking error versus spot natural gas prices. This dynamic has been particularly relevant over the past year, as weak demand and elevated inventories kept near term prices under pressure.

The UNG expense ratio, which has historically been approximately 1.11% annually, also plays a role in long-term performance, particularly for investors holding the fund over extended periods. While the fund is widely used for short-term trading and tactical investing strategies, longer holding periods can magnify the impact of roll costs, fees, and market structure effects. For this reason, many investors closely evaluate UNG’s net asset value, or NAV, relative to its benchmark index when assessing whether the fund is worth buying, holding, or selling during a given period.

Weak Third-Quarter Natural Gas Prices and the Inventory Overhang

During the third quarter, U.S. natural gas prices remained weak, with Henry Hub prices falling nearly 5% over the period. Forecasts calling for an unusually hot summer failed to materialize, as average temperatures ended the season roughly 3% cooler than normal. This moderation in weather-driven demand allowed inventories to build steadily. Natural gas stocks began the injection season slightly below the ten-year average but finished the summer roughly 150 billion cubic feet above that benchmark, representing an increase of about 4%. This inventory surplus weighed heavily on near month contracts, directly influencing UNG price performance during the quarter.

As prices fell decisively below $3.00 per million British thermal units, a broadly bearish mood settled over the natural gas market. From a trading perspective, daily changes in UNG reflected this pessimism, with investors reacting to weekly storage reports, short-term weather models, and futures expiration cycles. Over a two-week window following particularly bearish inventory data, UNG experienced heightened volatility as traders adjusted positions ahead of contract expiration dates.

The Growing Gap Between U.S. and Global Natural Gas Prices

One of the most striking features of the current market is the widening gap between U.S. natural gas prices and international prices. While Henry Hub prices have struggled below $3.00 per mmbtu, international natural gas prices have continued to trade in the $10 to $12 range. On an energy-equivalent basis relative to oil, U.S. natural gas would imply a price closer to $10 per mmbtu. This discrepancy has significant implications for investors evaluating the United States Natural Gas Fund, as it highlights the potential for convergence if domestic market conditions tighten.

Analysts argue that this price dislocation has been driven by a series of temporary factors rather than a permanent shift in fundamentals. Two of the last three winters were significantly warmer than normal, suppressing heating demand and inflating storage levels. In addition, delays in major liquefied natural gas export projects postponed roughly 6 billion cubic feet per day of incremental demand, nearly a 50% increase relative to the current LNG export base of approximately 13 bcf per day. These delays pushed the convergence trade further into the future, frustrating bullish investors but not eliminating the underlying thesis.

U.S. Natural Gas Supply Shows Signs of Structural Slowdown

A central argument gaining traction among some market observers is that U.S. natural gas supply growth is no longer as robust as headline figures suggest. According to EIA data, dry gas production reached approximately 109 bcf per day in August, up about 3.6 bcf per day year over year. However, a closer evaluation of shale production reveals a more nuanced picture. U.S. gas shales now account for more than 80% of total supply, and nearly all recent growth has come from the Permian Basin.

Data comparing December 2023 to August 2025 shows that every major shale play outside the Permian has either flattened or declined. Marcellus production fell from 27.76 to 27.42 bcf per day, Haynesville declined from 13.34 to 12.85 bcf per day, and Utica slipped from 6.69 to 6.42 bcf per day. In contrast, Permian gas rose from 17.8 to 20.83 bcf per day, accounting for virtually all net growth. This concentration raises questions about sustainability, particularly as Permian oil production has already turned negative on a year-over-year basis.

Why Permian Gas Growth May Be Nearing Its Peak

The Permian Basin presents a unique dynamic because much of its gas production is associated with oil drilling. As oil wells mature, they tend to produce a higher proportion of gas, creating what some analysts describe as a temporary “gas burp.” While this has allowed Permian gas output to continue rising even as oil production stalls, the effect is likely finite. Estimates suggest that Permian gas could still increase by as much as 1 bcf per day over the next 12 to 18 months before declining alongside oil output.

If this scenario plays out, incremental Permian gains may be offset by declines elsewhere, leaving total U.S. shale gas production flat or lower. For the United States Natural Gas Fund, such a shift would materially alter market conditions, potentially tightening balances and supporting higher near month contract prices tracked by the fund.

LNG Exports, Data Centers, and the Demand Outlook

On the demand side, structural forces continue to build. LNG exports are ramping rapidly, with net exports expected to average roughly 17 bcf per day through the coming winter, up from about 13 bcf per day last year. Remarkably, LNG exports alone have increased by approximately 2 bcf per day over just the past two months. At the same time, electricity demand from data centers and AI-driven infrastructure is rising, with natural gas expected to play a central role in meeting incremental power needs.

Inventory dynamics further complicate the picture. As of early winter, storage levels sit about 138 bcf above the five-year average, a sharp reversal from February when inventories were 230 bcf below average. Historically, storage declines by about 1.9 trillion cubic feet between November 1 and April 1. Under even slightly milder-than-normal winter conditions, withdrawals could approach 2.3 tcf, potentially pushing inventories nearly 300 bcf below average by spring.

What This Means for UNG Investors

For investors evaluating UNG, these developments underscore the importance of understanding both short-term trading mechanics and longer-term structural trends. In the near term, UNG remains sensitive to daily changes in futures prices, contract expiration cycles, and roll dynamics. Over longer periods, however, tightening supply, rising LNG exports, and converging global prices could create a more favorable environment for the fund’s benchmark to appreciate.

The United States Natural Gas Fund is not a buy-and-hold equity investment and does not pay dividends. Instead, it functions as a trading and investing vehicle designed to reflect movements in natural gas prices over defined periods. As market conditions evolve, investors will continue to assess whether UNG is worth holding, selling, or using as part of broader commodities strategies. With U.S. natural gas trading at a steep discount to global prices and structural supply questions emerging, the fund may once again become a focal point for investors seeking exposure to a potential shift in the natural gas market cycle.

READ ALSO: Above Food (ABVE) to Issue 1.1 Billion New Shares in Merger and Perpetua Resources (PPTA) Soars 171% as U.S. Approves $1.3B Gold-Antimony Mine.