In today’s rapidly evolving technological landscape, the integration of robotics and artificial intelligence (AI) into various sectors is reshaping industries and creating unprecedented opportunities. Companies at the forefront of this revolution, such as UiPath Inc., iRhythm Technologies, NVIDIA Corporation, and SU Group Holdings Limited, are driving significant innovations that enhance efficiency, safety, and operational capabilities across diverse fields.

UiPath Inc., a leader in robotic process automation (RPA), leverages its cutting-edge software to automate repetitive tasks, optimizing processes and driving operational efficiency across industries. With a strategic focus on AI-powered automation, UiPath is transforming how businesses operate, making it a standout in the robotics sector.

iRhythm Technologies, a pioneer in wearable biosensing technology, offers advanced solutions for remote heart rhythm monitoring. Their innovative approach in the healthcare sector allows for early detection and diagnosis of cardiac issues, positioning iRhythm as a key player in healthcare robotics.

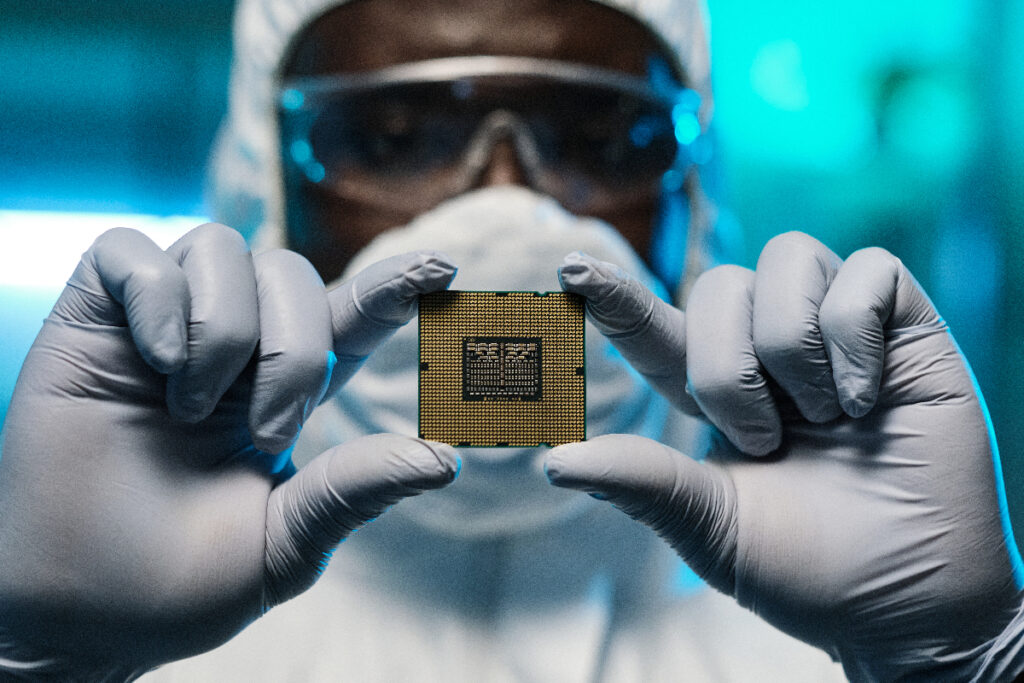

NVIDIA Corporation, widely recognized for its high-performance graphics processing units (GPUs), has expanded its expertise into AI and robotics. By providing the essential hardware for AI-driven applications, NVIDIA has become a crucial player in the AI and robotics space, driving significant technological advancements.

SU Group Holdings Limited, through its partnership with SquareDog Robotics, is developing AI-enabled robotic security solutions aimed at enhancing security patrolling. This collaboration focuses on creating a comprehensive robotic and AI system capable of improving patrol efficiency, safety, and cost-effectiveness while addressing labor shortages.

This article delves into the recent developments, strategic initiatives, and market impacts of these leading companies, highlighting their roles in shaping the future of robotics and AI. Through a detailed analysis, we explore how each company is leveraging technology to drive innovation and deliver cutting-edge solutions across various sectors.

NVIDIA Corporation (NASDAQ: NVDA) – Dominating AI and GPU Technology for Advanced Applications

NVIDIA Corporation is renowned for its high-performance graphics processing units (GPUs) but has significantly expanded into artificial intelligence (AI) and robotics. This expansion has positioned NVIDIA as a pivotal player in AI-driven applications, making it a strong investment in the robotics and AI sectors.

NVDA Latest News and Developments

Most recently Hewlett Packard Enterprise (NYSE: HPE) and NVIDIA announced a new collaboration called “NVIDIA AI Computing by HPE,” which features a portfolio of co-developed AI solutions and joint go-to-market integrations. This initiative aims to accelerate the adoption of generative AI across various industries.

Key offerings include:

- HPE Private Cloud AI: A turnkey, private cloud solution for AI, providing deep integration and the capability to manage AI workloads efficiently.

- Generative AI Capabilities: Enhanced by NVIDIA’s AI technology, these solutions are designed to help enterprises leverage generative AI for improved operational efficiency and innovation.

This partnership underscores the commitment of both companies to driving enterprise transformation through advanced AI and computing technologies.

NVIDIA 2024 Financial Performance

Q4 Fiscal 2024 Results

NVIDIA reported a revenue of $22.1 billion for the fourth quarter, marking a 22% increase from the previous quarter and a 265% increase year-over-year. The company’s net income jumped to $12.3 billion, a 33% increase from Q3.

Full Year Fiscal 2024

The company achieved a total revenue of $60.9 billion, reflecting strong demand across its product lines. GAAP earnings per share were $4.93, up 765% year-over-year.

Strategic Initiatives

Generative AI and AI Infrastructure

NVIDIA continues to innovate with the introduction of generative AI capabilities and collaborations with major enterprises like Cisco to deploy AI infrastructure. The company’s GPUs, such as the H100, are critical for AI operations and training complex algorithms.

Healthcare and Medical Imaging

The introduction of NVIDIA MONAI™ cloud APIs aims to integrate AI into medical imaging, enhancing diagnostic capabilities.

Market and Industry Recognition

AI and Gaming

NVIDIA remains a leader in AI and gaming technologies, with significant contributions to both fields. The launch of the GeForce RTX™ 40 SUPER Series GPUs and advancements in AI for RTX PCs exemplify their technological leadership.

NVDA 2024 Stock Market Performance

Stock Growth

NVIDIA’s stock has seen substantial growth, with a 768% increase over the past 18 months. Analysts remain bullish on its long-term potential, projecting continued dominance in the AI chip sector.

Future Projections

Analysts forecast NVIDIA to maintain its strong market position, driven by continuous innovation and expansion into new markets such as custom AI chips, which present a $30 billion opportunity.

NVIDIA’s Challenges and Risks

Market Competition

Increasing competition in the AI and semiconductor markets may impact NVIDIA’s market share. The company’s response to this competition will be crucial in maintaining its leadership position.

Insider Selling

Recent stock sales by CEO Jensen Huang have raised questions about potential market performance and insider expectations.

Key Points to Watch

- Technological Advancements: Continuous innovation in AI and GPU technologies will be vital for maintaining NVIDIA’s competitive edge.

- Financial Health: Monitoring NVIDIA’s revenue growth and profitability will provide insights into its operational efficiency and market reception.

- Market Expansion: Success in expanding into new markets, such as custom AI chips and healthcare applications, will drive future growth.

NVIDIA Corporation’s strategic expansions and robust financial performance position it well in the AI and robotics sectors, making it a strong investment for those looking to capitalize on technological advancements in these fields.

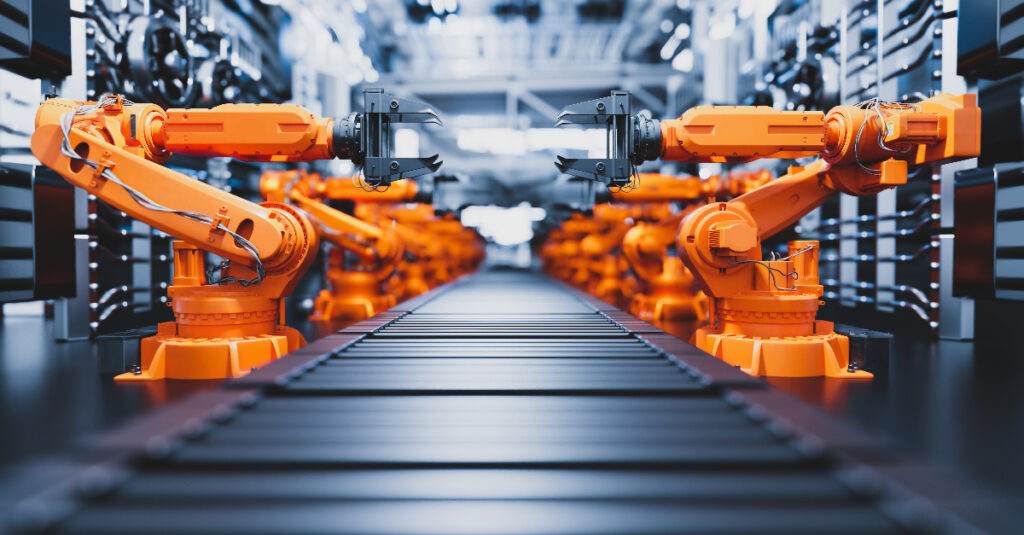

SU Group Holdings Limited (NASDAQ: SUGP) – Transforming Security with AI-Enabled Robotic Solutions

SU Group Holdings Limited is an integrated security-related services company that provides security-related engineering services, security guarding and screening services, and vocational training in Hong Kong. Recently, SU Group announced a strategic partnership with SquareDog Robotics to develop AI-enabled robotic security solutions aimed at enhancing security patrolling.

Latest News and Developments

Partnership with SquareDog Robotics

The collaboration focuses on creating a comprehensive robotic and AI system to improve patrol efficiency, safety, and cost-effectiveness while addressing labor shortages in the security sector.

Key Roles of Robotics and AI in this Initiative

- Surveillance:

- Capabilities: Robots equipped with cameras, sensors, and sometimes drones will conduct thorough surveillance.

- Functionality: They will capture and analyze real-time footage to detect suspicious activities or unauthorized individuals, enhancing the surveillance capabilities of security teams.

- Patrolling:

- Capabilities: Autonomous robots will patrol predefined routes or areas.

- Functionality: These robots will continuously monitor for intrusions or anomalies, efficiently covering large areas and reducing the need for human patrols.

- Threat Detection:

- Capabilities: Robots will be equipped with motion detectors, heat sensors, and chemical sensors.

- Functionality: They can detect potential threats like intruders, fires, or hazardous materials, alerting security personnel immediately upon detection.

- Communication:

- Capabilities: Some robots will feature two-way communication systems.

- Functionality: This allows security personnel to remotely interact with individuals in the patrolled area, useful for issuing warnings or providing assistance.

- Deterrence:

- Capabilities: The presence of security robots.

- Functionality: Their presence can act as a deterrent to potential intruders or vandals, reducing the likelihood of criminal activities.

- Data Collection and Analysis:

- Capabilities: Robots will collect and analyze data about their surroundings.

- Functionality: This helps in identifying patterns, trends, and potential security risks, providing valuable insights for improving security measures.

- Integration with Existing Systems:

- Capabilities: Robots can be integrated with existing security systems.

- Functionality: They can work with access control and alarm systems, providing a comprehensive security solution that responds automatically to alarms or breaches.

Strategic Goals and Benefits

- Enhanced Security: The partnership aims to develop a breakthrough solution that enhances security in various environments, making buildings more secure and attractive places to work, live, and visit.

- Operational Efficiency: By leveraging AI and robotics, the initiative seeks to optimize patrol efficiency, improve cost-effectiveness, and solve labor shortage problems in the security industry.

- Technological Advancement: The collaboration highlights SU Group’s commitment to technological innovation and its strategic move to integrate cutting-edge AI and robotics into its service offerings.

The partnership between SU Group Holdings Limited and SquareDog Robotics represents a significant advancement in the field of security patrolling. By integrating AI and robotics, this collaboration aims to enhance the efficiency, safety, and overall effectiveness of security operations, addressing key challenges such as labor shortages and the need for comprehensive surveillance solutions. This initiative is poised to set a new standard in the security industry, making environments more secure and appealing for all stakeholders.

Financial Performance

Q4 Fiscal 2024 Results

SU Group reported robust financial performance for the fourth quarter, reflecting strong demand for its security services. The company’s revenue increased significantly, driven by new contracts and enhanced service offerings.

Full Year Fiscal 2024

For the full fiscal year, SU Group achieved substantial revenue growth, underpinned by its diversified service portfolio and strategic market expansion.

Strategic Initiatives

Expansion of Service Offerings

SU Group has continuously expanded its service offerings to include advanced security solutions and vocational training programs. This expansion has enabled the company to cater to a broader client base and meet evolving security needs.

Technological Integration

The company has been at the forefront of integrating cutting-edge technology into its services. This includes the use of advanced surveillance systems, biometric screening, and AI-driven security solutions to enhance operational efficiency and safety.

Market and Industry Recognition

Leadership in Security Services

SU Group is recognized as a leader in the security services industry in Hong Kong. The company’s commitment to innovation and excellence has earned it a strong reputation and a loyal client base.

Training and Development

The company’s vocational training programs are highly regarded, providing essential skills and certifications to security professionals, thus contributing to the overall improvement of industry standards.

Stock Market Performance

Stock Growth

SU Group’s stock has demonstrated steady growth, reflecting investor confidence in its strategic direction and financial health. The company’s focus on innovation and expansion has been well-received in the market.

Future Projections

Analysts are optimistic about SU Group’s future, forecasting continued growth driven by technological advancements and market expansion.

Challenges and Risks

Market Competition

The security services market is highly competitive, with numerous players vying for market share. SU Group’s ability to innovate and maintain its technological edge will be crucial in sustaining its leadership position.

Regulatory Changes

Changes in regulatory frameworks and compliance requirements can impact operations. The company’s proactive approach to regulatory compliance and industry standards will be essential in mitigating these risks.

Key Points to Watch

- Technological Advancements: Continuous innovation in security technology, including AI and biometric solutions, will be vital for maintaining SU Group’s competitive edge.

- Financial Health: Monitoring SU Group’s revenue growth and profitability will provide insights into its operational efficiency and market reception.

- Market Expansion: Success in expanding into new markets and enhancing service offerings will drive future growth.

SU Group Holdings Limited’s strategic expansions and robust financial performance position it well in the security services sector. The company’s commitment to innovation and excellence makes it a strong investment for those looking to capitalize on advancements in security technology and services.

UiPath Inc. (NYSE: PATH) – Pioneering Robotic Process Automation for Operational Efficiency

UiPath Inc. is a leader in robotic process automation (RPA) software that automates repetitive tasks across various industries, optimizing processes and driving operational efficiency. The company’s strategic foresight and innovative technologies make it a standout in the robotics sector.

Latest News and Developments

UiPath has recently introduced several new features to its Business Automation Platform, aiming to help organizations build more efficient and comprehensive automations. The key highlights include:

- UiPath Autopilot: A tool for developers and testers that leverages Generative AI (GenAI) and natural language processing (NLP) to create workflows, generate expressions, and build automations within UiPath Studio. This feature enhances productivity by simplifying the automation creation process.

- Enhanced AI Integration: The platform now deeply integrates GenAI capabilities, which allows businesses to achieve greater outcomes with AI-driven automation. This includes advanced AI tools that support both citizen developers and professional developers, enabling faster implementation of automation solutions.

These new features aim to transform millions of tasks and processes across enterprises, making automation more accessible and efficient. UiPath showcased these capabilities at the “UiPath on Tour London: AI at Work” summit, highlighting their commitment to driving AI-powered productivity in business automation.

UiPath 2024 Financial Performance

Q1 Fiscal 2025 Results

UiPath reported a revenue of $326 million, marking a 24% increase from the previous quarter. The company’s Annual Recurring Revenue (ARR) also grew by 24% to $1.378 billion.

Q2 Fiscal 2024 Results

Revenue for the second quarter reached $287.3 million, a 19% year-over-year increase. ARR increased by 25% year-over-year to $1.308 billion, with a GAAP gross margin of 83% and a non-GAAP gross margin of 86%.

Stock Repurchase Program

The company announced a $500 million stock repurchase program authorized by the Board of Directors, reflecting confidence in its future and commitment to building shareholder value.

Strategic Initiatives

Generative AI and Specialized AI Offerings

UiPath introduced AI-powered automation features, including the general availability of OpenAI and Azure OpenAI connectors with support for GPT-4. The company also previewed Google Vertex connector with support for PaLM 2.

AI-powered Developer Tools

New platform features for developers include enhanced low-code tools, solution accelerators, and automated testing, aimed at accelerating automation across all knowledge work.

Market and Industry Recognition

Industry Leader

UiPath has been recognized as a leader in multiple industry assessments, including the Everest Group Intelligent Document Processing (IDP) Products report, Process Mining Products PEAK Matrix® Assessment 2023, and Task Mining Products PEAK Matrix® Assessment 2023.

UiPath 2024 Financial Outlook

Q3 Fiscal 2024 Projections

UiPath expects revenue in the range of $313 million to $318 million, ARR between $1.359 billion and $1.364 billion, and non-GAAP operating income of approximately $32 million.

Full Year Fiscal 2024 Projections

For the full fiscal year, the company projects revenue between $1.273 billion and $1.278 billion, ARR between $1.432 billion and $1.437 billion, and non-GAAP operating income of approximately $188 million.

Challenges and Risks

Sales Execution

The company has faced challenges with sales execution, impacting large deal closures and necessitating adjustments in revenue and ARR growth projections.

Stock-Based Compensation

High levels of stock-based compensation (SBC) continue to impact cash flow. The management is working on reducing sales and marketing (S&M) and general and administrative (G&A) expenses to mitigate this impact.

UiPath remains a significant player in the RPA sector, leveraging its technological advancements and strategic initiatives to maintain its market leadership. The company’s focus on AI integration and platform enhancements positions it well for continued growth and operational efficiency improvements.

iRhythm Technologies Inc. (NASDAQ: IRTC) – Leading Wearable Biosensing Technology for Heart Health

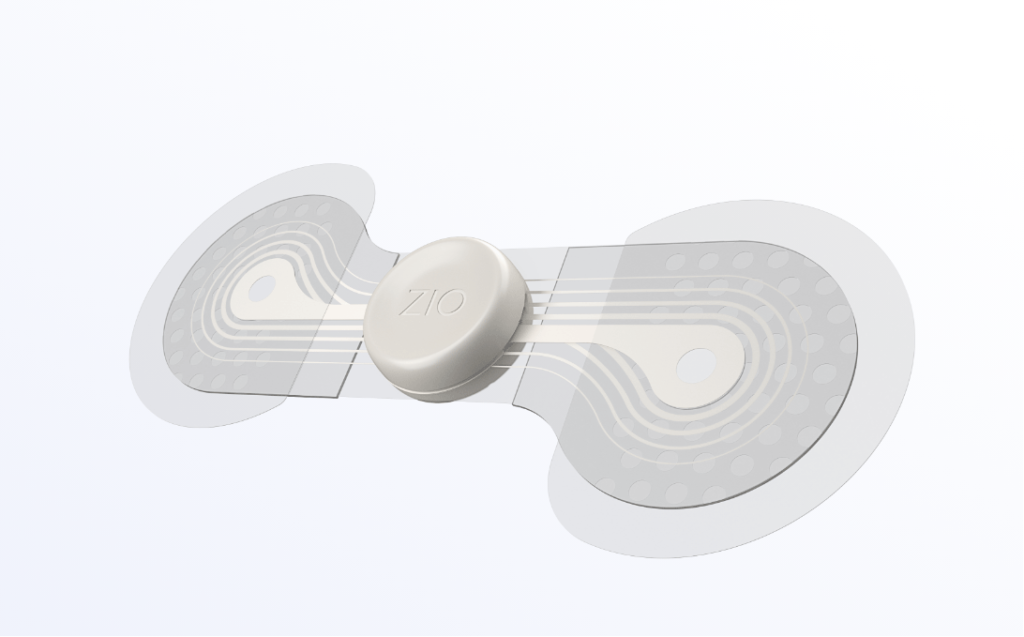

iRhythm Technologies Inc. specializes in wearable biosensing technology that monitors heart rhythms remotely. Their flagship product, the Zio service, provides long-term and short-term continuous ambulatory cardiac monitoring, enabling early detection and diagnosis of arrhythmias. This positions iRhythm as a key player in healthcare robotics and digital health.

Latest News and Developments

iRhythm Technologies, Inc. announced that their Zio service has been shown to significantly prevent hospital admissions and aid in the early detection of atrial fibrillation (AF). The findings were presented at the American College of Cardiology’s 71st Annual Scientific Session (ACC.22).

Key highlights include:

- Clinical Research Findings: Three clinical studies demonstrated that the Zio service is effective in detecting AF early, allowing for timely intervention and treatment.

- Impact on Hospital Resources: The use of Zio AT saved one healthcare system 136 inpatient hospitalization days, showcasing its potential to alleviate hospital resource burdens.

- Benefits for Older Adults: The Guard-AF study, which included 5,713 participants, revealed that Zio XT detected AF in 4.5% of older adults within two weeks of monitoring, highlighting its effectiveness in a primary care setting.

These results underscore the Zio service as a viable solution for enhancing cardiac care and reducing healthcare costs through early detection and prevention of severe cardiac events.

Financial Performance

Q1 2024 Results

iRhythm reported revenue of $131.93 million for the first quarter of 2024, marking an 18.39% increase year-over-year. However, the company posted a loss of $1.47 per share, missing analysts’ estimates by $0.48 per share.

Revenue Growth

For the twelve months ending March 31, 2024, iRhythm’s revenue was $513.17 million, showing a 19.35% year-over-year growth.

Future Projections

Analysts forecast iRhythm’s stock price to reach an average target of $130.88, representing a 32.24% potential upside from the current price. The highest target is set at $165.00.

Strategic Initiatives

Manufacturing Automation

iRhythm has launched the initial phase of manufacturing automation, which is expected to enhance operational efficiency and scalability.

International Expansion

The company is focusing on revenue growth through expansion into new markets and increasing its presence in existing ones.

Market and Industry Recognition

Operational Milestones

iRhythm continues to achieve significant operational milestones, including advancements in their manufacturing processes and presentations at major medical technology conferences.

Challenges and Risks

Financial Losses

Despite revenue growth, iRhythm has been facing financial losses, which have impacted its stock performance. The company reported a loss of $4.23 per share over the past year.

Class Action Lawsuits

iRhythm has been subject to class action lawsuits related to securities law violations, which could impact its financial health and market perception.

Key Points to Watch

- Revenue and Profitability: Monitoring the company’s ability to increase revenue while managing financial losses will be critical.

- Technological Advancements: Continued innovation in wearable biosensing technology and the expansion of their product offerings will be essential for maintaining a competitive edge.

- Market Expansion: Success in international markets and strategic partnerships will play a significant role in driving growth.

iRhythm Technologies is well-positioned in the healthcare robotics sector with its innovative cardiac monitoring solutions. However, addressing financial challenges and legal issues will be crucial for sustaining long-term growth and stability.

Serve Robotics Inc. (NASDAQ: SERV) – Revolutionizing Last-Mile Delivery with Autonomous Sidewalk Robots

Serve Robotics Inc. (NASDAQ: SERV) is a company that focuses on autonomous sidewalk delivery solutions. The company, which is a spin-off from Uber, specializes in the development and deployment of robots designed to handle last-mile deliveries. Their robots are increasingly used for food delivery, particularly in urban settings.

Latest News

Serve Robotics Inc. has announced an expansion of its delivery operations into Koreatown, Los Angeles, as part of a long-term plan to extend its geographic reach across the U.S. In conjunction with this expansion, Serve has also extended its lidar supply agreement with Ouster, Inc. to equip 2,000 next-generation robots with upgraded sensors for enhanced performance.

Key Highlights:

- Expanded Delivery Operations:

- Geographic Reach: Serve Robotics is now offering its delivery services in Koreatown, leveraging the area’s dense commercial hub, growing residential community, and robust sidewalk infrastructure.

- Partnership with Uber Eats: The company has begun onboarding local merchants in partnership with Uber Eats. Koreatown residents ordering through Uber Eats can now have their orders fulfilled by Serve’s autonomous delivery robots.

- Extended Lidar Supply Agreement:

- Technology Integration: The extended agreement with Ouster, Inc. includes the deployment of Ouster’s new REV7 sensors. These sensors will enhance the robots’ ability to perceive their environment, identify precise locations, and safely navigate through urban environments.

- Operational Benefits: The upgraded lidar technology is expected to improve the safety, speed, and cost-effectiveness of Serve’s delivery fleet, supporting the company’s goal of deploying up to 2,000 robots by 2025.

- Strategic and Financial Implications:

- Commitment to Growth: This expansion signifies Serve Robotics’ commitment to growth and increasing market penetration. By leveraging cutting-edge technology and strategic partnerships, the company aims to maintain its competitive edge in the autonomous delivery market.

- Investment in Technology: The continued investment in advanced lidar technology underscores Serve’s dedication to enhancing its robots’ capabilities, ensuring they remain at the forefront of autonomous delivery solutions.

Stock Performance and Market Activity

Serve Robotics’ stock has experienced significant fluctuations recently, with a notable 142.77% increase over the past three months. This sharp rise can be attributed to various strategic moves and partnerships that the company has announced.

The stock price has varied greatly, showing a 229.69% change over the last five trading days and a 268.29% change over the last 30 days.

Recent Developments

Expanded Delivery Service

Serve Robotics has expanded its delivery service to cover Koreatown, Los Angeles. This move is part of a larger strategy to scale their operations and increase their footprint in urban areas.

New Leadership Appointment

The company recently appointed Euan Abraham as the Chief Hardware & Manufacturing Officer, reflecting their focus on strengthening their manufacturing capabilities.

Strategic Partnerships

Serve Robotics signed a long-term agreement with Magna International for the manufacturing and licensing of its delivery robots. This partnership aims to scale the production of up to 2,000 robots to support their delivery operations, including those for Uber Eats.

Financial Updates

Public Offering and Uplisting

Serve Robotics completed a $40 million public offering and uplisted to the Nasdaq Capital Market under the ticker “SERV” in April 2024. This move was aimed at increasing their market visibility and access to capital.

First Quarter 2024 Results

The company reported revenue of $0.95 million for the first quarter of 2024, marking a 124% sequential growth in delivery and branding revenue.

Technological Integrations

Serve Robotics has integrated DriveU.auto’s connectivity platform to support the scale deployment of their robot fleet. This integration is expected to enhance the operational efficiency and connectivity of their delivery robots.

Stock Market Changes

Stock Price

As of the latest trading sessions, SERV stock is trading at $11.31, which represents a significant increase of 49.74% in the past 24 hours.

Volatility and Performance

The stock has shown high volatility, with a beta coefficient of -8.99. It has also demonstrated substantial short-term growth, rising by 387.28% over the last week and 482.73% over the last month.

Analyst Forecast

Analysts have provided mixed forecasts for SERV’s future price, suggesting a potential maximum estimate of $8.00.

Key Points to Watch

- Expansion and Partnerships: Continued expansion of delivery areas and strategic partnerships, such as those with Magna International and DriveU.auto, will be crucial for Serve Robotics’ growth.

- Leadership and Governance: New appointments and the composition of the leadership team will play a significant role in driving the company’s technological and market strategies.

- Financial Health: Monitoring quarterly financial results and market cap changes will provide insights into the company’s operational efficiency and profitability.

Serve Robotics is positioned as a notable player in the autonomous delivery market, with substantial recent growth and strategic initiatives that indicate potential for continued expansion and market penetration.

Richtech Robotics Inc. (NASDAQ: RR) – Innovating Service Robots for Enhanced Efficiency in Hospitality and Healthcare

Richtech Robotics Inc. (NASDAQ: RR) is a Nevada-based company that provides AI-driven service robots aimed at enhancing efficiency in various industries, including hospitality, healthcare, and food service.

Latest News and Developments

Richtech Robotics Inc. has announced the successful completion of installing its advanced robotic beverage system, ADAM, at Ghost Kitchens inside a Walmart in Dawsonville, Georgia. This milestone marks the beginning of a broader rollout, with plans to install ADAM in 240 locations across the United States.

Key Highlights:

- Integration at Ghost Kitchens:

- Location: The installation at the Dawsonville, GA Walmart represents the first execution of the partnership between Richtech Robotics and Ghost Kitchens International.

- Functionality: ADAM serves a variety of beverages, including traditional and specialty coffee drinks, providing a unique and efficient customer experience.

- Customer Experience:

- Reception: Customers have responded positively to ADAM’s introduction, enjoying the novelty and consistency of having a robotic barista.

- Best Seller: The Iced Foamy Hazelnut Latte has become a crowd favorite at this location.

- Technological Advancements:

- Capabilities: ADAM’s AI-driven features include precise drink preparation, intelligent conversation AI with voice activation, and natural language processing, enhancing customer interaction and service efficiency.

- Operational Efficiency: The integration of ADAM aims to streamline operations, reduce waste, and allow human staff to focus on more value-added tasks.

- Strategic Partnership:

- Future Plans: Ghost Kitchens plans to deploy ADAM in all current and upcoming locations to enhance operational capabilities and customer engagement.

- Support and Maintenance: Richtech Robotics will be responsible for the programming, maintenance, and repair of the ADAM systems, ensuring seamless operations.

This initiative underscores Richtech Robotics’ commitment to revolutionizing the service industry through advanced automation and innovative solutions.

Richtech Robotics Stock Performance

As of July 22, 2024, Richtech Robotics’ stock is trading at $1.61, marking a 9.93% increase from the previous close. The stock had a significant rise in the morning trading session, opening at $1.92.

Despite fluctuations, the stock has experienced a dramatic decrease of 75.3% since the beginning of 2024, previously trading at $5.95.

Recent Announcements

Installation of ADAM at Ghost Kitchens

Richtech Robotics celebrated the completion of the installation of its robotic solution ADAM at Ghost Kitchens inside Dawsonville, GA Walmart. This installation is part of a larger rollout plan across 240 locations in the US.

Elevator-Enabled Medbot

The company launched an elevator-enabled Medbot designed to improve efficiency in healthcare facilities by automating the safe and secure delivery of medications, addressing the shortage of pharmacy staff.

Joint Venture with Zipphaus

Richtech Robotics announced a joint venture with Zipphaus to launch robot-operated cafes in locations such as hospitals, airports, and schools.

Advanced AI Capabilities

At CES 2024, Richtech Robotics unveiled new AI capabilities for its robotic bartender ADAM, showcasing human-like performance in executing complex tasks such as pouring draft beer.

Public Offering and Funding

Earlier in 2024, the company closed a $40 million public offering and uplisted to the Nasdaq Capital Market under the ticker “RR”. This move aims to enhance their financial position and support further expansion.

Key Points to Watch

- Expansion and Partnerships: The company’s strategic partnerships and expansions, especially the rollout of ADAM in Ghost Kitchens and the joint venture with Zipphaus, are crucial for their growth.

- Technological Innovations: The development and deployment of advanced AI capabilities in their robots will play a significant role in their market positioning.

- Financial Health: Monitoring their quarterly financial results and stock market performance will provide insights into their operational efficiency and market reception.

Richtech Robotics is positioned to leverage its AI-driven solutions to address critical needs in various service industries, potentially driving growth and market penetration in the coming years.