We recently published our article Top 5 Copper Stocks to Buy Right Now. Here, we look at where One and One Green Technologies Inc. (NASDAQ:YDDL) fits as copper’s “critical metal” status strengthens, electrification and grid spending keep demand in focus, and investors hunt for high-quality copper producers with real operating leverage, disciplined capital spending, and credible growth runways.

Copper sits in that rare corner of the market where “boring industrial metal” turns into a front-page macro story the moment the world accelerates electrification. It’s the backbone of modern power systems, and it shows up everywhere investors actually care about in 2026: grid modernization, renewable energy buildouts, electric vehicles, charging infrastructure, data centers, robotics, defense electronics, and the never-ending need to move more electricity with less loss. That’s why people keep searching “copper stocks,” “best copper stocks,” and “copper mining stocks” whenever risk appetite returns—because the copper price doesn’t just reflect construction cycles anymore, it increasingly reflects an electrified economy that needs more wiring, more transformers, more substations, and more high-voltage transmission than the existing system was built to handle.

The Copper Supply Deficit Problem Nobody Fixes Quickly

The copper bull narrative keeps coming back for a simple reason: demand is getting pulled by multiple megatrends at the same time, while supply is slow, political, and capital-intensive. New mines take years to permit, finance, build, and ramp, and the industry has to fight declining ore grades, water constraints, power costs, and social license issues in key jurisdictions. That supply friction is exactly why the market obsesses over the phrase “copper supply deficit” and why “copper price forecast” content performs so well—investors know the metal can swing hard when demand surprises, when supply gets disrupted, or when inventories tighten. In practical terms, copper investing is a tug-of-war between physics (you need conductive metal), infrastructure reality (grids and electrification are hardware-heavy), and mining reality (bringing new tonnage online is slow and messy).

How Investors Actually Play Copper Mining Stocks

That creates two main ways people play the sector. The first is the classic copper producer route—large, liquid copper miners whose earnings and cash flow tend to torque with copper price moves. That’s where bellwether names like Freeport-McMoRan Inc. and Southern Copper Corporation come in, because the market often treats them like “copper sentiment ETFs with a management team.” When the tape turns risk-on and commodities catch a bid, these are frequently where institutions and fast money start because liquidity is deep and the copper beta is obvious. The second route is higher-torque growth and rerating potential—smaller copper miners that can move faster (and more violently) on expansion progress, cost performance, or project execution, which is why names like Ero Copper Corp. and Hudbay Minerals Inc. stay on watchlists whenever copper demand headlines heat up.

Why Copper Stocks Swing So Hard

What makes the sector especially volatile is that copper is both macro-sensitive and structurally constrained. A short-term economic slowdown can hit sentiment and pull copper prices down, but the medium-term infrastructure backlog doesn’t magically disappear—grids still need upgrades, EV adoption still needs chargers and distribution capacity, and data centers still need dense electrical buildouts. That whiplash is why copper mining stocks can look sleepy for months and then suddenly trend for weeks when the market refocuses on electrification, inventories, permitting bottlenecks, or the next wave of infrastructure spending. For SEO, this is the sweet spot: “copper miners,” “copper producers,” “copper demand,” and “copper supply” aren’t just keywords—they’re the actual drivers investors debate every day.

The Recycling Angle That’s Getting Bigger

Recycling and secondary supply add another layer that’s increasingly important for the copper story, because the world can’t mine its way out of every shortage on a comfortable timeline. “Copper recycling” and “copper scrap” matter more when demand accelerates and policymakers start caring about supply-chain resilience. That’s also where a less traditional name like One and One Green Technologies, Inc. fits into the broader sector conversation: not as a classic copper miner, but as a higher-risk angle tied to processing/recycling dynamics and industrial metals exposure. In other words, the copper trade is no longer only about digging ore out of the ground—it’s about the entire pipeline of concentrate, smelting/refining capacity, scrap flows, and the ability to reliably supply conductive material into an economy that is wiring itself up at scale.

Why “Best Copper Stocks” Keeps Trending

The bottom line for a sector intro like this is simple: copper is the “electrification metal,” and that label pulls in both long-term investors looking for structural demand and traders hunting momentum in commodity-linked equities. When copper prices firm, the best copper stocks often rerate quickly because the market starts pricing a tighter future—especially when the headlines emphasize grids, EVs, renewable energy, and AI data centers at the same time. That’s why a Top 5 copper stocks list works: it’s a clean way to frame the two core investor questions—who has the most direct copper leverage right now, and who has the best setup if the next leg of copper demand keeps surprising higher.

CHECK THIS OUT: Top 5 Best Cybersecurity Micro-Caps to Watch in 2026 and Top 10 Best Small-Cap Stocks To Buy Right Now.

Our Methodology

We screened NYSE/NASDAQ stocks with meaningful copper exposure and ranked them using a weighted score based on market cap/liquidity, copper revenue leverage, recent momentum, financial quality (profitability, balance sheet, valuation), and near-term catalysts (production growth, expansions, approvals). We then applied a final qualitative check to confirm direct copper linkage and avoid low-relevance names.

YOU MUST READ THIS!!! – 5 Best Cheap Stocks to Buy Right Now

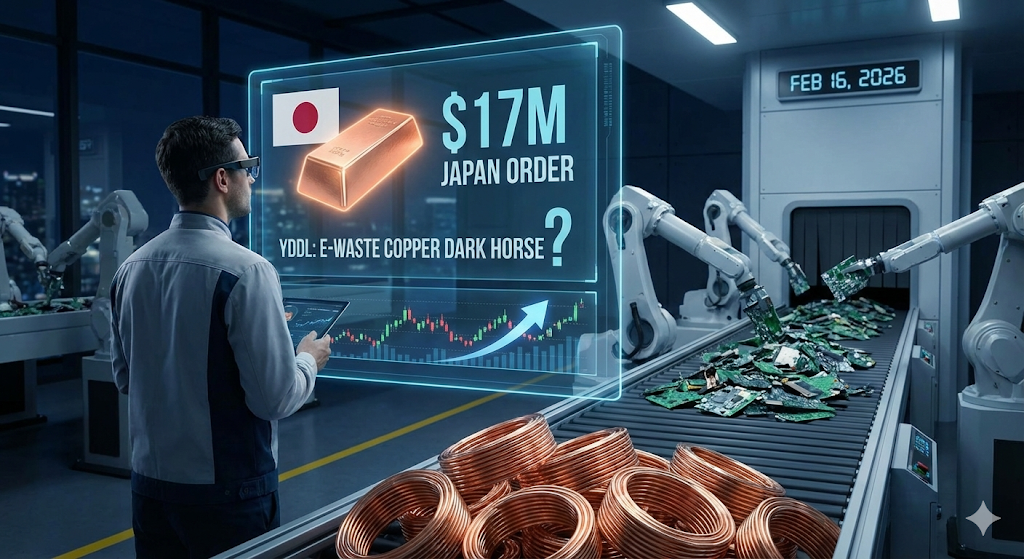

5. One and One Green Technologies Inc. (NASDAQ:YDDL)

Score: 66/100

Market cap: $361.64M

One and One Green Technologies, Inc. (NASDAQ: YDDL) is a Philippines-based recycling company that says it is authorized by Philippine regulators (DENR and Customs) to import and process hazardous and general solid waste, then convert that feedstock into non-ferrous metal products such as copper alloy ingots and aluminum products. The business model is straightforward: secure steady inbound scrap/e-waste supply, process it at its facility in San Rafael, Bulacan, then sell finished metal products to industrial customers, with performance ultimately driven by feedstock availability, recovery yields, selling prices, and operating efficiency.

The February 4, 2026 announcement is a purchase order, not a completed sale. The company said it received a purchase order from Japan China Trading Co., Ltd. (Osaka, Japan) with a stated value of about $17 million to supply up to 16,000 metric tons of shredded electronic assemblies and scrap metal. The company also stated shipments will only start after the supplier completes export licensing requirements, and deliveries would occur over up to one year. YDDL said the materials are intended for processing at its San Rafael facility to recover copper, aluminum, gold, silver, and other metals. The only thing this confirms today is demand interest and potential supply pipeline—execution depends on licensing timing, shipment flow, and YDDL’s ability to process volume without yield or cost issues.

Separate from that purchase order, YDDL has published operating and contract updates that describe what it has already delivered. In a January 2026 operating update, the company reported delivering 7,481 tons of recycled copper alloy ingots and aluminum alloy products to customers in China and the Philippines during the second half of 2025. In another January 2026 release, it said it secured approximately $39 million in second-half 2025 contracts and highlighted that copper alloy products represented a large share of contract value, alongside growth in aluminum product contracts. These statements are still company-provided, but they’re at least tied to shipped volumes and contract totals rather than future intent.

For financial results, YDDL reported (unaudited) first-half 2025 revenue of about $28.1 million, gross margin of 25.3%, and net income of about $3.83 million, and it indicated copper ingots were the largest revenue line in that period. Those figures give you a baseline for scale and profitability claims, but they don’t remove the core risks: this is a small public company where results can swing on scrap sourcing, product pricing, operating discipline, and customer concentration.

The risks you should not ignore are structural. The company’s own disclosures describe meaningful reliance on a small number of counterparties (high concentration), and because this is an importer/processor of regulated waste streams, operational continuity depends on maintaining licenses and staying compliant with customs and environmental rules. On top of that, the “$17 million” headline is conditional—if export licensing drags, feedstock timing shifts, and the expected throughput/revenue timing shifts with it.

READ ALSO: Why QuantumScape (QS) Keeps Disappointing Traders but Fascinating Long-Term EV Investors. and The Quiet Semiconductor Disruptor You’ve Never Heard Of: Aeluma Inc (ALMU).

Disclosure: No material interests to disclose. This article was originally published on Global Market Bulletin.