PLDT Inc. (NYSE:PHI) is the Philippines’ oldest, largest, and most integrated telecommunications and digital services provider, with a proud legacy that dates back nearly a century. Founded in 1928, PLDT—short for Philippine Long Distance Telephone Company—has been at the forefront of connecting Filipinos across generations, evolving from a traditional fixed-line operator into a dynamic, tech-forward company powering the nation’s digital economy. With its deep infrastructure network, strong nationwide brand, and strategic business units, PLDT is the heartbeat of the Philippines’ communications landscape and a major player in the Southeast Asian tech ecosystem.

Through its key subsidiaries—Smart Communications for wireless, PLDT Home for broadband, and ePLDT for enterprise and data center services—PLDT has built a comprehensive suite of services that includes mobile and fixed-line connectivity, fiber broadband, digital TV, cybersecurity, cloud computing, managed services, and data center colocation. With over 70 million mobile subscribers, 3 million fixed broadband users, and thousands of corporate and government clients, PLDT is embedded into every aspect of modern Philippine life—homes, offices, businesses, schools, and public institutions.

But PLDT’s relevance today goes far beyond connectivity. In the last decade, the company has made bold investments to pivot into a digital-first organization, leveraging artificial intelligence, cloud computing, and smart infrastructure to meet the changing demands of consumers and enterprises. Its cutting-edge VITRO Data Center network, currently undergoing aggressive expansion, is designed to support the exponential growth of hyperscalers, fintech, BPOs, gaming, content delivery networks, and smart cities in the Philippines and across Asia.

As a publicly listed company on both the Philippine Stock Exchange and the New York Stock Exchange under the ticker PHI, PLDT is also a gateway for global investors seeking exposure to one of Asia’s fastest-growing digital markets. Its commitment to innovation, sustainability, and inclusive growth has won numerous accolades in corporate governance, investor relations, and ESG standards.

PLDT’s strategic partnerships with global technology leaders, its pioneering role in fiber deployment, and its leadership in 5G, AI, and enterprise IT make it not just a telco, but a digital enabler for the Philippines and a rising force in Asia’s digital infrastructure arena. With a forward-looking vision, sound financials, and a deep understanding of local market dynamics, PLDT is uniquely positioned to capitalize on the ongoing digital transformation of Southeast Asia and deliver sustainable, long-term value to customers, partners, and shareholders alike.

Financial Performance Anchored by Recurring Revenues and Market Leadership

PLDT’s financials remain robust even amid global macroeconomic headwinds. In Q1 2025, the company reported an attributable net income of PHP 9.03 billion, a modest year-over-year decline of 8.04%, primarily due to one-off adjustments. However, its total revenues rose 1.95% to PHP 55.28 billion, compared to PHP 54.22 billion in the same period last year. Service revenues, which form the backbone of the company’s recurring earnings, increased by 2.34% to PHP 53.42 billion. These figures confirm the company’s financial resilience and ability to generate stable income from its core operations.

Enterprise services, in particular, stood out during the quarter. PLDT’s enterprise revenues hit PHP 11.9 billion, driven by the unrelenting demand for digital transformation services from businesses across the Philippines. Corporate data and ICT revenues rose by 1% to PHP 8.8 billion, reaffirming the company’s growing presence in mission-critical B2B solutions.

At a valuation level, PLDT remains attractively priced. As of late May 2025, the stock trades at a forward P/E of 7.29 and a price-to-cash-flow ratio of just 2.92—both below industry averages—signaling substantial upside potential. The company also maintains a healthy return on equity of 28.45%, highlighting efficient capital allocation and solid profitability.

CHECK THIS OUT: Aurora Mobile (JG) Turns Profitable and aTyr Pharma Can Be the Biotech Breakout of 2025.

Enterprise Business Drives New Growth Amid Digital Acceleration

According to PLDT Senior Vice-President and Enterprise Business Head Patricio S. Pineda III, the company’s enterprise division is expected to be a key growth engine throughout the year. In an interview during the BusinessWorld Economic Forum, Mr. Pineda emphasized that the company is “well-positioned to take advantage of the emerging needs of a lot of our customers,” especially in an increasingly digital business environment.

PLDT’s comprehensive ICT suite, combined with its growing presence in international markets and regional B2B expansion, equips the enterprise segment to tap into high-demand areas such as cybersecurity, managed network services, hybrid cloud, and unified communications. Mr. Pineda noted that the strength of PLDT’s data center business is also a crucial differentiator, enabling the company to cater to hyperscalers, multinational corporations, and local enterprises seeking secure and scalable hosting solutions.

Data Center Expansion and Digital Infrastructure Leadership

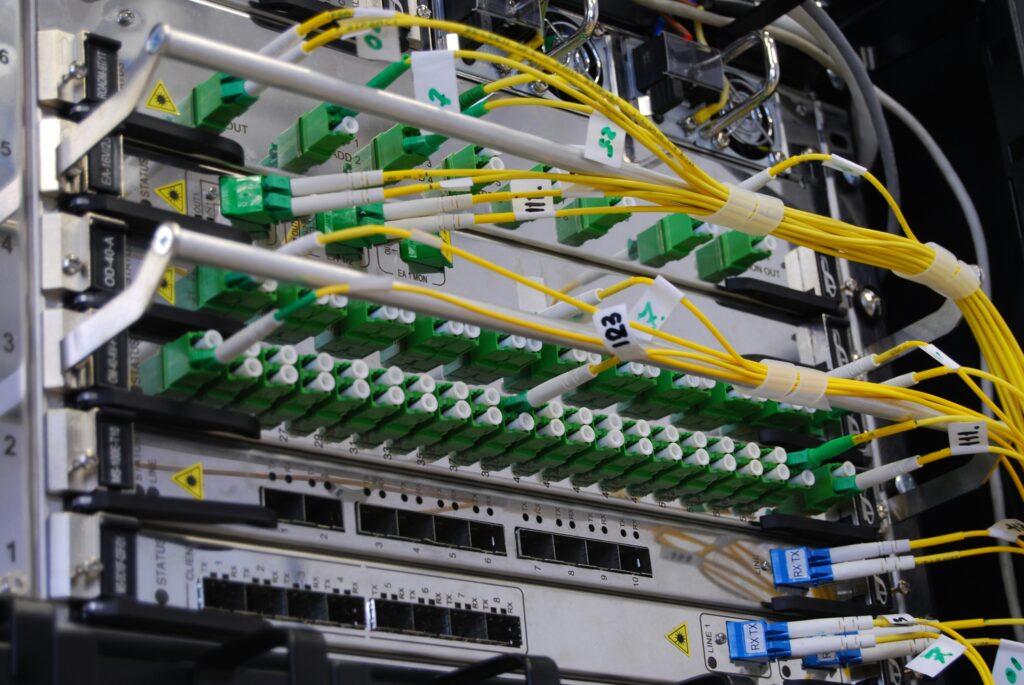

One of PLDT’s most ambitious bets is on its data center business, led by ePLDT and the VITRO Data Center portfolio. With facilities like the VITRO Santa Rosa campus, PLDT is building one of the largest, most energy-efficient hyperscale data center infrastructures in the region. This investment comes at a time when demand for data storage, processing power, and AI workload hosting is exploding.

PLDT’s ability to offer end-to-end digital infrastructure—from fiber backbone to Tier-3 and Tier-4 data center hosting—gives it a powerful competitive edge over both domestic and regional rivals. As cloud adoption rises and enterprises migrate their workloads to hybrid environments, PLDT is set to benefit from long-term contracts, higher margins, and increased customer stickiness.

Strategic Positioning in a Digitally-Driven Economy

As the Philippines continues to transition into a digital-first economy, PLDT’s unmatched scale, legacy, and vertical integration make it indispensable to the nation’s connectivity goals. The company has fiber-optic coverage in all major cities, mobile connectivity across 96% of the population, and deep relationships with government, enterprise, and consumer markets. It has also taken steps to fortify its cybersecurity offerings and streamline its digital customer experience platforms.

With over 70 million mobile subscribers, 3 million fixed-line broadband users, and thousands of enterprise clients, PLDT is uniquely positioned to grow its average revenue per user (ARPU) across all segments. It also enjoys a low churn rate due to bundled services and long-term contracts, ensuring predictable cash flows and a stable earnings base.

Investor Sentiment and Dividend Strength

Investor confidence in PLDT remains strong, especially among those seeking exposure to emerging market infrastructure. On May 28, 2025, PLDT shares gained 3.25%, closing at PHP 1,271 per share. Analyst price targets range from $25 to $31.30, implying up to 36% upside from current levels. Moreover, PLDT’s dividend yield remains attractive at approximately 5.55%, offering steady passive income in addition to long-term capital appreciation.

Its commitment to shareholder returns, even while investing aggressively in digital infrastructure, highlights the company’s disciplined financial management and ability to balance growth with profitability. For income-focused investors and those betting on Asia’s digital economy, PLDT presents a rare combination of yield, stability, and upside potential.

Conclusion: PLDT Is a Long-Term Winner in Southeast Asia’s Digital Future

PLDT Inc. stands at the crossroads of tradition and transformation. As the Philippines’ most established telecom brand, it brings with it a legacy of trust, quality, and nationwide reach. But more importantly, PLDT is embracing the future—through strategic investments in cloud, AI, data centers, cybersecurity, and enterprise ICT.

Despite a complex operating environment, PLDT has demonstrated financial resilience, operational excellence, and strong shareholder alignment. Its enterprise momentum, innovative infrastructure rollout, and favorable valuation metrics make it a clear contender for investors looking to ride Southeast Asia’s digital growth wave. With strong dividend support, recurring service revenues, and first-mover advantage in multiple tech verticals, PLDT Inc. (NYSE: PHI) is a stock that deserves serious attention—and long-term conviction.

READ ALSO: FingerMotion (FNGR): A Hidden Gem and iRobot (IRBT) is Undervalued: Strong Margins & AI Innovation Suggest Upside Potential.