Nvidia Corporation (NASDAQ: NVDA) stands as a testament to what innovation and visionary leadership can achieve. Under the helm of its co-founder and CEO, Jensen Huang, Nvidia has not just thrived but eclipsed its competitors, commanding a valuation that dwarfs the combined worth of its primary rivals. However, amidst this meteoric rise, questions about the sustainability of its “rocket ship” valuation loom large.

The Double-Edged Sword of Innovation

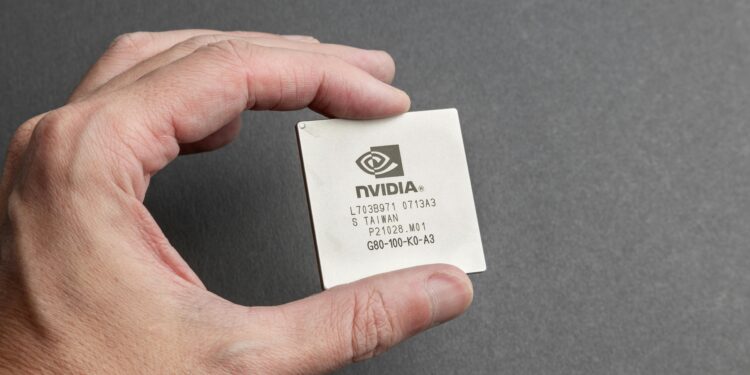

Nvidia’s journey from a graphics card specialist to a cornerstone of AI and computing is nothing short of remarkable. Its GPUs, known for parallel processing prowess, have become indispensable in AI applications, powering over 75% of the world’s top supercomputers. The company’s claim of offering full-stack solutions, bolstered by specialized algorithms and libraries, is supported by over 1,600 generative AI companies leveraging Nvidia’s platform.

Yet, as Nvidia navigates the post-Moore’s Law era with its accelerated computing, its heavy reliance on Taiwan Semiconductor (TSM) for chip fabrication introduces significant geopolitical risk. The specter of geopolitical tensions, particularly in the Taiwan Strait, coupled with U.S. restrictions on advanced chip exports to China, casts a shadow over Nvidia’s supply chain and market access.

The Competitive Landscape Intensifies

The competitive threat is multi-dimensional. Traditional rivals like AMD are closing the technology gap, while Intel’s initiatives to erode Nvidia’s CUDA ecosystem could dilute its software moat. More ominously, major customers such as Amazon, Microsoft, and Google are developing their own AI chips, aiming to circumvent Nvidia’s premium pricing.

Cloud giants, driven by their massive purchasing power and strategic investments in AI startups, are not just customers but emerging competitors. Amazon’s investment in Anthropic and Microsoft’s tailored AI chips for Azure underscore this shift. Even in gaming, a stronghold for Nvidia, AMD’s resurgence, powered by strategic acquisitions and console market dominance, signals intensifying competition.

Financial Fortitude vs. Market Realities

Nvidia’s financial metrics paint a picture of success, with soaring revenues and impressive gross margins of around 74%. However, this financial prowess is shadowed by an over-reliance on the data center market, where the tide is turning as customers seek alternatives to Nvidia’s chips.

The push towards share repurchases, to the tune of $9.5 billion in FY24, raises questions about the company’s strategic priorities amidst escalating competitive pressures. Nvidia’s bet on growth segments like automotive is promising, yet it’s the data center segment, with its volatile infrastructure demand, that remains the linchpin of Nvidia’s financial health.

Valuation in the Stratosphere

Nvidia’s valuation, with EV/Revenues multiples soaring to 35x, is eye-watering by any standard. While this premium reflects Nvidia’s past growth and profitability, the sustainability of such multiples is debatable in the face of mounting competition and market saturation.

A Balanced Outlook

While Nvidia’s achievements and contributions to the tech landscape are undeniable, the current valuation raises legitimate concerns. The company faces not just the challenge of maintaining its technological edge but also navigating a complex geopolitical landscape and an increasingly competitive market where even its customers are turning into rivals.