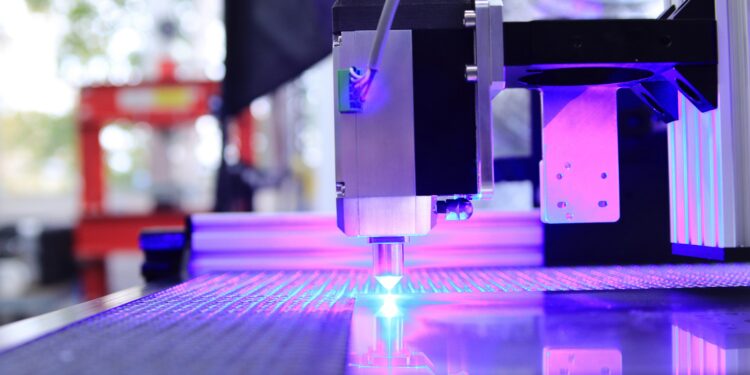

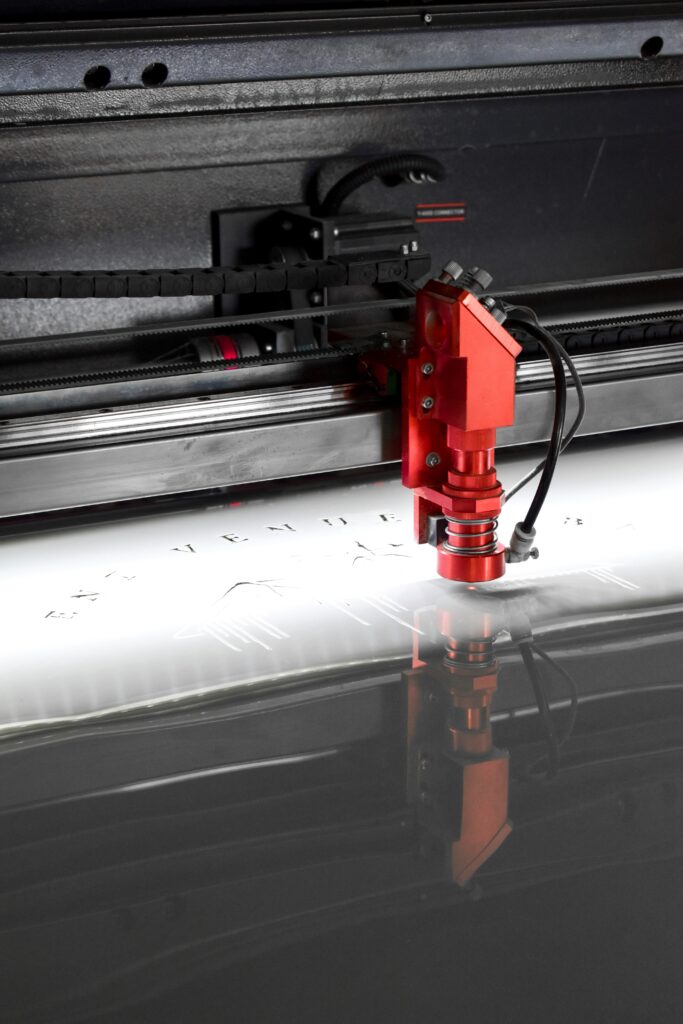

nLIGHT Inc. (NASDAQ:LASR) is a leading provider of high-power semiconductor and fiber lasers that are used across a wide range of industrial, defense, aerospace, and scientific applications. Founded in 2000 and headquartered in Camas, Washington, the company has built its reputation by designing and manufacturing vertically integrated laser technologies that combine precision, reliability, and scalability. Over the years, nLIGHT has positioned itself at the forefront of photonics innovation, leveraging its proprietary semiconductor laser diodes and advanced fiber laser architectures to deliver products that serve some of the most demanding use cases in the global economy.

The company operates with a unique structure that integrates semiconductor production, fiber design, and laser system development under one roof, enabling it to maintain control over costs, performance, and intellectual property. Its technology powers critical applications ranging from metal cutting and welding to additive manufacturing, semiconductor processing, and microelectronics. In recent years, nLIGHT has also become a key player in the aerospace and defense industry, providing directed energy solutions and high-power laser systems that support national security and next-generation military platforms. These capabilities have earned it a place in large U.S. Department of Defense programs and have cemented its reputation as a trusted supplier of advanced laser systems.

Beyond its technology, nLIGHT is notable for its consistent commitment to research and development. The company has invested heavily in creating programmable and field-serviceable laser solutions that allow customers to optimize beam quality, adapt to different manufacturing environments, and reduce downtime. Its Corona fiber laser platform, for instance, offers tunable beam shapes that give manufacturers new flexibility and efficiency, setting it apart from conventional laser solutions. This focus on innovation has helped nLIGHT capture opportunities in industries where precision and performance drive competitiveness.

While nLIGHT is still considered a small-cap company, it has demonstrated strong growth potential by aligning itself with fast-expanding markets such as advanced manufacturing, aerospace, and defense modernization. Its ability to scale technology and adapt to evolving industrial and military demands places it in a unique position among photonics companies. With an expanding global footprint, a growing base of institutional investors, and strategic participation in defense and industrial programs, nLIGHT has established itself as a vital player in the laser and photonics ecosystem.

Record-Breaking Stock Performance Highlights Momentum

nLIGHT, Inc. has emerged as one of the most striking performers in the electrical equipment sector, recently hitting a new 52-week high of $30.56 on September 15, 2025. This milestone represents a staggering 146.52% increase in stock price over the past year, dwarfing the 17.67% gain of the S&P 500 during the same period. Even more impressive, the stock has rallied nearly 187.11% in the last 12 months, while also outperforming broader indices across the three-month and three-year timeframes. This kind of price action reflects a strong combination of investor enthusiasm, institutional accumulation, and growing recognition of nLIGHT’s technological positioning in high-growth markets such as defense and industrial lasers.

CHECK THIS OUT: CEL-SCI (CVM) Stock Could Explode After Saudi Breakthrough Deal and Ondas Holdings (ONDS) Lands $2.7M Defense Order.

Market Capitalization and Financial Profile

With a current market capitalization of $1.42 billion, nLIGHT has transitioned into a formidable small-cap contender in the optical and laser technology industry. Despite being classified as loss-making on the basis of negative earnings and a return on equity of −19.76%, the company’s ability to rally strongly underscores the forward-looking nature of investor interest. Its price-to-book ratio of 6.58 suggests that markets are pricing in robust growth potential, while a debt-to-equity ratio of −0.42 highlights its relatively unique capital structure. Unlike many peers, nLIGHT does not pay dividends, a signal that management is reinvesting resources back into scaling technology, R&D, and product delivery to capture long-term market share.

Explosive Revenue Growth and Operational Upside

nLIGHT has posted some of its strongest top-line results in recent quarters. Net sales for Q2 2025 reached $61.73 million, reflecting consistent expansion in its aerospace and defense business as well as selective traction in industrial and sensing markets. This surge in revenue has been accompanied by margin improvement, which investors see as a stepping stone toward sustained profitability. Despite volatility in operating profit, which has declined historically at a compounded annual rate of −170.71% over the past five years, the company is showing signs of an inflection point as scale in its higher-margin defense segment offsets softness in traditional industrial demand.

Defense and Aerospace Contracts Powering Growth

A central driver of nLIGHT’s bullish story is the rapid expansion of its Aerospace and Defense (A&D) revenue. In Q2 2025, A&D revenue surged nearly 49% year-over-year to $40.7 million, representing two-thirds of total company revenue. Programs such as HELSI-2, which aims to develop a megawatt-class laser for the U.S. Department of Defense, and the DE M-SHORAD initiative, which integrates directed energy systems into mobile platforms, validate nLIGHT’s technology at the highest levels of national security. These projects are not only large in scale but also long in duration, offering recurring revenue visibility and strengthening the company’s positioning as a strategic supplier to governments and defense contractors.

Institutional Confidence at All-Time Highs

Another bullish signal lies in institutional ownership, which now sits at an extraordinary 97.46%, up 6.4% in the most recent quarter. Such high levels of institutional backing reflect strong conviction among professional investors who have the resources to analyze fundamentals, evaluate competitive moats, and anticipate sector trends. This level of accumulation often serves as a catalyst for both liquidity and stability, making nLIGHT stock more resilient to retail-driven volatility. The increase in institutional stakes during a period of soaring share prices indicates that major investors believe nLIGHT’s rally still has further room to run.

Market Outperformance Demonstrates Investor Conviction

nLIGHT’s trajectory from a 52-week low of $6.20 to its high of $30.56 captures the volatility inherent in the small-cap technology space, but it also highlights the explosive upside possible for companies at critical inflection points. Outperforming the S&P 500 across multiple timeframes confirms that investors view nLIGHT not simply as a speculative bet but as a credible growth story aligned with powerful secular trends in directed energy, laser-based manufacturing, and defense modernization. This outperformance is particularly notable given that the company is still in the process of stabilizing profitability, underscoring investor willingness to look beyond near-term losses toward transformative long-term potential.

Conclusion: A High-Growth Story With Long-Term Potential

The bullish thesis for nLIGHT rests on the convergence of explosive stock performance, rapid revenue growth, and dominance in the defense laser market. With record A&D sales, deepening institutional ownership, and clear visibility into high-value government programs, the company has momentum that could continue to propel shares higher. While risks remain around profitability and operational efficiency, the combination of strong top-line expansion, defense sector validation, and institutional backing positions nLIGHT as a small-cap growth story with the potential to become a mid-cap industry leader. Investors willing to navigate volatility may find the reward profile highly attractive as nLIGHT capitalizes on secular demand for advanced laser and photonics technologies.

READ ALSO: How Globalstar (GSAT)’s Strategic Apple Partnership is Changing the Satellite Game and Intel (INTC)’s Epic Comeback: Why Wall Street May Be Dead Wrong About This “Dying” Chip Giant.