Zebra Technologies Corporation (NASDAQ:ZBRA) is a global innovator in enterprise asset intelligence, empowering businesses around the world to achieve real-time operational visibility, data-driven decision-making, and digital transformation at scale. Headquartered in Lincolnshire, Illinois and founded in 1969, Zebra has grown from a barcode printing specialist into one of the most trusted providers of end-to-end technology solutions for tracking, sensing, and managing critical assets across multiple industries.

Over the past five decades, Zebra has become synonymous with operational efficiency. Its broad portfolio includes mobile computers, barcode scanners, RFID systems, thermal printers, workforce communication tools, real-time location systems (RTLS), and advanced software platforms—all designed to provide actionable insights where work happens. Zebra’s technologies are used in more than 100 countries and trusted by over 80% of Fortune 500 companies, especially in mission-critical environments such as supply chains, healthcare facilities, retail stores, manufacturing floors, transportation hubs, and warehouses.

Zebra Technologies is widely recognized as the backbone of modern commerce and logistics. From enabling contactless deliveries and digital shelf management to powering patient ID wristbands and asset tracking in hospitals, Zebra plays a central role in ensuring that goods, data, and people are where they need to be—efficiently and accurately. As companies increasingly invest in automation, AI, and Internet of Things (IoT) technologies, Zebra has positioned itself at the forefront of this global shift with intelligent edge solutions that bridge physical operations with digital control.

In recent years, the company has accelerated its transformation by expanding into high-growth verticals such as robotics, machine vision, predictive analytics, and cloud-based device management. Its strategic acquisitions—most notably of Fetch Robotics and Photoneo—have deepened its capabilities in smart automation, warehouse robotics, and 3D machine vision, further reinforcing Zebra’s role as a leader in intelligent automation and real-time enterprise visibility.

Backed by a legacy of innovation, strong customer loyalty, and a recurring revenue model that blends hardware, software, and services, Zebra Technologies continues to deliver exceptional value to both its enterprise customers and long-term investors. With global digitization trends gaining momentum, Zebra stands out as a mission-critical technology partner driving the future of connected operations.

Q1 2025 Financial Results Reinforce Momentum and Demand Strength

Zebra’s first-quarter 2025 financial results exceeded expectations, reinforcing the company’s operational strength and rising demand for its enterprise solutions. The company posted revenue of $1.31 billion, up 11.3% year-over-year, driven by broad-based strength across verticals and geographies. Adjusted earnings per share surged 42% to $4.02, showcasing strong operating leverage and successful margin preservation despite inflationary headwinds and supply chain challenges.

The quarter’s performance validated the company’s strategic investments in automation, mobile computing, and cloud-based platforms, which are now paying off in both customer loyalty and top-line growth. With continued improvements in operational execution and disciplined expense control, Zebra is on solid footing to deliver further earnings acceleration throughout the remainder of 2025.

CHECK THIS OUT: Lakeside Holding Limited (LSH): Key Insights and Strategic Developments and Lakeside Holding (LSH) Deepens Roots in Pharmaceutical Logistics with $1.5M Sinopharm Agreement.

Analysts Turn More Bullish as Zebra Broadens Its Reach and Product Depth

Investor confidence in Zebra Technologies received a significant boost on June 4, 2025, when Baird analyst Richard Eastman raised his price target on the stock to $320 from $290, while maintaining an Outperform rating. This upgrade reflects a reassessment of Zebra’s long-term strategic positioning and its growing relevance across automation-heavy sectors.

According to Eastman, Zebra’s continued innovation in asset tracking, mobile computing, and real-time data visibility has positioned it to capitalize on multi-year trends shaping enterprise IT. The analyst emphasized Zebra’s unique ability to serve the evolving needs of logistics, healthcare, and retail clients that are rapidly shifting toward automation, analytics, and connected systems.

Baird highlighted that Zebra’s improved operational discipline and successful navigation of supply chain constraints have enhanced investor confidence in both near-term execution and long-term value creation. The company’s commitment to research and development, even during macroeconomic headwinds, ensures that its product pipeline remains robust, timely, and differentiated in an increasingly crowded tech landscape.

Strategic Acquisitions and R&D-Driven Innovation Are Fueling Future Growth

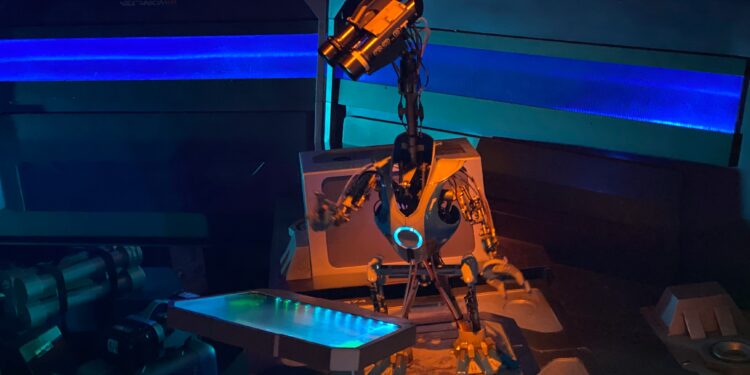

Zebra’s growth strategy hinges on innovation and thoughtful market expansion. The company has consistently reinvested into advanced technologies through both organic development and strategic acquisitions. Notably, its recent acquisition of Photoneo, a leader in 3D machine vision and AI-driven automation, marks a strategic pivot into next-generation robotics and smart factory technologies.

This move expands Zebra’s reach beyond its core competencies in barcode scanning and inventory tracking, allowing it to penetrate higher-value applications such as robotic picking, defect inspection, and autonomous material handling. With the integration of AI and vision systems, Zebra is now competing not just in hardware but in the broader ecosystem of industrial intelligence — a market with multi-billion-dollar potential.

Eastman emphasized that Zebra’s expansion into advanced analytics, robotics, and intelligent automation is a key lever for future margin expansion and top-line acceleration. The company’s ability to layer high-margin software and AI on top of its already extensive hardware ecosystem positions it as a formidable player in enterprise tech — one that can scale with the digital transformation journeys of Fortune 500 clients and small businesses alike.

Market Positioning, Strong Execution, and Recurring Revenue Model Drive Investor Appeal

Zebra’s ability to outperform the broader market and deliver consistent earnings growth has made it a favorite among institutional investors. The company’s customer base is diversified across industries and continents, providing a resilient foundation for growth regardless of macroeconomic volatility. In addition, Zebra’s growing mix of software, services, and recurring revenue enhances visibility and improves its long-term financial outlook.

Zebra’s current valuation, supported by double-digit growth rates and strong free cash flow generation, presents an attractive setup for long-term investors. The company is trading well below its historical highs, but with fundamentals improving, guidance increasing, and analyst targets rising, the stock appears primed for reacceleration.

While some commentators point to more aggressive upside potential in high-risk AI stocks, Zebra represents a balanced growth opportunity with proven execution, expanding end markets, and a durable technology moat. For investors seeking exposure to the automation megatrend without the speculative volatility of early-stage names, ZBRA offers a compelling case.

Conclusion: Zebra Technologies Is Quietly Powering the Global Automation Revolution

Zebra Technologies is not just keeping up with the evolution of enterprise technology — it’s helping lead it. Through a powerful combination of cutting-edge innovation, strategic foresight, and operational discipline, the company has secured its place as an indispensable partner for businesses looking to digitize and optimize their operations.

The bullish case for Zebra is built on fundamentals: strong earnings growth, visionary acquisitions, expanded addressable markets, and rising analyst confidence. With new price targets being raised and enterprise demand for automation and visibility only growing, ZBRA stock stands out as a high-quality, long-term investment opportunity in the heart of the digital transformation era.

READ ALSO: Lakeside Holding (LSH) Acquires Hupan Pharmaceutical to Enter China’s Medical Logistics Market and Lifeway Foods (LWAY): Probiotic Pioneer Targets $195M Revenue in 2024.