Born out of academic research and commercial ambition at the dawn of modern computer vision, this company emerged with a clear mission: to teach cars how to see, understand, and react to the world around them using software and silicon rather than human intuition. What began as a university-based research effort quickly evolved into a commercial enterprise focused on solving one of the hardest problems in transportation—reducing accidents and improving road safety through advanced driver-assistance systems and, ultimately, autonomous driving technology. From its earliest days, the company positioned itself not as an automaker, but as a foundational technology supplier aiming to power the intelligence layer inside vehicles across the global automotive industry.

Mobileye Global Inc. (NASDAQ:MBLY) was founded in 1999 in Jerusalem by Professor Amnon Shashua, a pioneer in computer vision and artificial intelligence, alongside entrepreneur Ziv Aviram. The company’s early breakthroughs centered on monocular camera-based perception, an approach that challenged prevailing assumptions that expensive sensors were required for vehicle safety systems. By leveraging sophisticated algorithms and purpose-built processing chips, Mobileye demonstrated that cameras combined with advanced software could accurately identify lanes, pedestrians, vehicles, traffic signs, and other critical road elements. This technical philosophy became the cornerstone of its long-term strategy and differentiated it from many competitors.

Over the following years, Mobileye steadily embedded itself into the automotive supply chain by partnering with major global car manufacturers and Tier 1 suppliers. Its proprietary EyeQ system-on-a-chip family became a widely adopted platform for advanced driver-assistance features such as automatic emergency braking, lane-keeping assist, adaptive cruise control, and traffic sign recognition. As these features transitioned from luxury options to standard safety requirements, the company’s technology found its way into millions of vehicles worldwide, giving it an unparalleled dataset and real-world driving experience that continues to inform product development.

The company’s background is also closely tied to its acquisition by Intel in 2017, a landmark deal that valued the business at approximately $15 billion and signaled the growing strategic importance of automotive artificial intelligence. Under Intel’s ownership, Mobileye accelerated its investment in research and development, expanded its autonomous driving roadmap, and deepened its focus on scalable, production-ready solutions rather than experimental prototypes. This period marked a shift from being primarily an ADAS supplier to positioning itself as a full-stack provider of autonomous driving technologies, spanning hardware, software, mapping, and data services.

A key element of Mobileye’s evolution has been its emphasis on responsibility-sensitive safety models and mathematically verifiable driving policies. Rather than relying solely on brute-force machine learning, the company has consistently highlighted the importance of formal safety frameworks that can be validated and explained to regulators and automakers. This philosophy reflects its academic roots and has been central to its efforts to build trust in increasingly automated vehicle systems, especially as regulatory scrutiny intensifies globally.

When Mobileye returned to the public markets through a Nasdaq listing, it did so as a distinct entity with a sharpened focus on automotive autonomy and vision-based intelligence. As a standalone public company, it continued to expand its product portfolio across different levels of vehicle automation, from entry-level ADAS solutions to more advanced autonomous platforms designed for robotaxis and future mobility services. The company also advanced its mapping capabilities through crowd-sourced data, enabling high-definition road models that support automated driving at scale.

Throughout its history, Mobileye has maintained a close relationship with automakers navigating the transition toward software-defined vehicles. Its background reflects years of balancing innovation with the practical constraints of automotive production cycles, cost targets, and safety standards. This experience has allowed the company to integrate deeply into vehicle platforms while continuously iterating on performance and functionality as sensor technology, compute power, and artificial intelligence models evolve.

At its core, the company’s story is one of long-term vision meeting incremental deployment. From academic research labs to millions of cars on the road, Mobileye has built its identity around enabling safer driving through perception and intelligence. Its background illustrates how foundational technology companies can shape entire industries not by manufacturing end products, but by embedding intelligence into the systems that define modern mobility.

A High-Profile Investment That Masks Deeper Structural Risks

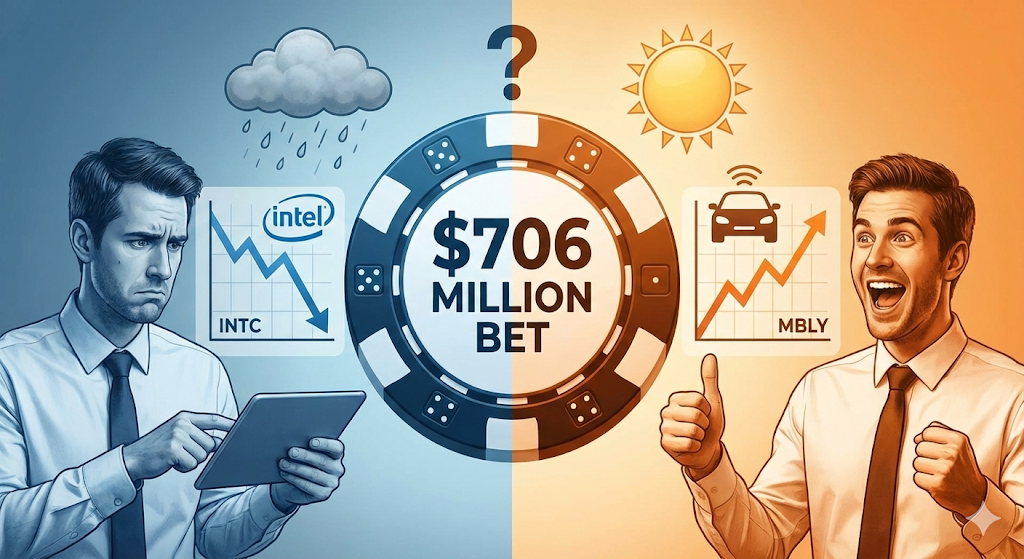

Mobileye Global Inc. has once again found itself at the center of market attention after Intel Corp disclosed a massive $706 million investment, acquiring 50 million shares and lifting its ownership stake to more than 6%. On paper, this looks like a powerful vote of confidence. Intel now counts Mobileye as the single largest holding in its reported portfolio, accounting for more than two-thirds of its disclosed positions. Yet for equity investors, this headline-grabbing move may be far less bullish than it appears. When examined closely, Intel’s increased exposure highlights concentration risk, structural dependency, and unresolved business model weaknesses rather than a clear validation of Mobileye’s long-term equity upside.

The market reaction has been telling. Despite the size and symbolism of the investment, Mobileye shares remain under pressure, trading near $10.50 and down meaningfully from prior highs. The stock’s inability to sustain momentum even after a marquee shareholder doubles down raises a critical question for investors: what does Intel see that public market participants do not, or conversely, what risks is the market already pricing in that this investment fails to resolve?

CHECK THIS OUT: The Quiet Semiconductor Disruptor You’ve Never Heard Of: Aeluma Inc (ALMU) and Air Industries Group (AIRI) Narrows Losses to Just $44K — Is This Aerospace Microcap Entering a Turnaround Phase?

Intel’s Stake Signals Strategic Necessity, Not Financial Strength

Intel’s decision to allocate such a disproportionate share of its portfolio to Mobileye reflects strategic alignment more than financial optimism. Mobileye remains a core pillar of Intel’s long-term vision for automotive AI, advanced driver-assistance systems, and autonomous driving platforms. From Intel’s perspective, maintaining influence over Mobileye is less about near-term returns and more about preserving optionality in a future mobility ecosystem that remains highly uncertain.

For minority shareholders, however, this dynamic introduces a clear imbalance. Mobileye’s strategic importance to Intel does not automatically translate into shareholder-friendly outcomes for public investors. In fact, it can constrain flexibility, as Mobileye’s roadmap may prioritize Intel’s ecosystem needs over aggressive margin expansion, capital returns, or independent strategic pivots. A dominant anchor shareholder can stabilize a company, but it can also anchor valuation expectations and limit upside rerating potential.

Profitability Remains Elusive Despite Earnings “Beats”

Recent quarterly results underscore a recurring theme in the Mobileye investment case: surface-level beats masking deeper financial fragility. The company reported earnings of $0.09 per share, slightly ahead of expectations, and delivered revenue of $504 million, also topping consensus estimates. Yet these numbers do little to change the underlying profitability profile. Mobileye continues to operate with a deeply negative net margin, sitting around minus 17%, and trades at a negative price-to-earnings ratio that reflects persistent losses rather than temporary volatility.

Revenue growth remains modest, rising less than 4% year over year, a troubling figure for a company still valued as a high-growth autonomous driving and ADAS leader. At this stage of market development, investors typically expect accelerating adoption curves, not low single-digit growth paired with expanding losses. The gap between narrative and financial reality continues to widen.

Valuation Compression Risk Is Still Front and Center

Even after a prolonged decline, Mobileye’s valuation remains vulnerable. The company carries a market capitalization of roughly $8.5 billion while producing limited earnings power and uncertain free cash flow prospects. Analysts may point to an average price target well above current levels, but the consensus rating remains a cautious “Hold,” reflecting the market’s lack of conviction.

More importantly, valuation frameworks that once justified premium multiples for autonomous driving leaders are under reassessment across the sector. As timelines for full autonomy extend and regulatory complexity grows, investors are increasingly unwilling to pay forward multiples for revenue streams that may take years, if not decades, to fully materialize. Mobileye sits squarely in this danger zone, where expectations remain elevated while tangible returns lag.

ADAS Is Becoming a Commodity, Not a Moat

One of the most underappreciated bearish factors for Mobileye is the gradual commoditization of advanced driver-assistance systems. Features such as lane keeping, adaptive cruise control, and collision avoidance are no longer viewed as premium differentiators. Automakers increasingly expect these capabilities as baseline functionality, placing constant pressure on pricing and margins.

At the same time, competitors ranging from in-house OEM solutions to rival chipmakers and software platforms are narrowing the technological gap. As ADAS shifts from innovation to infrastructure, Mobileye’s ability to command premium economics becomes increasingly questionable. The company’s long-term upside narrative depends heavily on higher levels of autonomy, yet those milestones remain distant and fraught with execution risk.

Autonomous Driving Timelines Keep Slipping

The broader autonomous driving industry continues to struggle with overpromising and underdelivering. Regulatory hurdles, safety validation requirements, and real-world deployment challenges have repeatedly pushed commercialization timelines further out. Mobileye is not immune to these realities. While its technology roadmap remains ambitious, widespread adoption of fully autonomous systems has yet to translate into scalable, high-margin revenue.

For investors, this creates a valuation trap. The stock is often priced on future autonomy scenarios that may not arrive on a predictable schedule, if at all. In the meantime, the company must fund ongoing research, development, and partnerships without the benefit of robust operating leverage.

Institutional Ownership Doesn’t Eliminate Downside Risk

Recent filings show increased activity from hedge funds and institutional investors, which some interpret as a bullish signal. However, institutional participation alone does not guarantee price stability or long-term appreciation. Many of these positions are tactical rather than conviction-driven, and can unwind quickly if sentiment shifts or earnings disappoint.

Moreover, institutional ownership remains relatively modest as a percentage of total shares outstanding, suggesting that large pools of capital are still hesitant to make Mobileye a core long-term holding. This lack of overwhelming institutional sponsorship reinforces the view that the stock remains in a wait-and-see phase rather than a clear accumulation zone.

The Core Bear Case: Strategic Importance Does Not Equal Equity Upside

The central bearish thesis for Mobileye Global Inc. is not that the company lacks technological relevance, but that its strategic importance does not automatically translate into attractive equity returns at current or even moderately higher prices. Intel’s $706 million investment underscores dependence and alignment, but it does not resolve profitability challenges, competitive pressures, or valuation risks.

Without a clear inflection toward sustainable margins, stronger organic growth, and improved capital efficiency, Mobileye risks remaining a strategically valuable asset trapped inside a structurally underwhelming public equity story. For investors seeking near- to medium-term upside driven by earnings expansion rather than narrative reinforcement, the stock continues to present more questions than answers.

In that light, Intel’s massive stake may be better viewed as a necessity-driven commitment rather than a bullish signal for public shareholders. Until fundamentals begin to catch up with ambition, Mobileye Global Inc. remains a compelling technology story but a fragile investment thesis, with downside risks that the market may not yet be done pricing in.

READ ALSO: Vuzix Corp (VUZI) Could Be the Dark Horse of Augmented Reality as Defense Contracts & Enterprise Adoption Accelerate and Almonty Industries (ALM) Is Quietly Becoming a Tungsten Powerhouse.