In the evolving landscape of minimally invasive medical devices, where precision, safety, and technological innovation define long-term success, the foundations of one France-based medical technology company reveal decades of focused development in ultrasound-driven urology solutions. Built around high intensity focused ultrasound and non-invasive therapeutic systems, the organization emerged from a clinical need to treat urological diseases more effectively while reducing surgical trauma for patients. Its origins are closely tied to scientific research, engineering rigor, and the belief that ultrasound technology could transform prostate cancer treatment, urinary tract stone management, and broader urology-based medical care through real-time, image-guided precision.

Established in France and headquartered in Vaulx-en-Velin near Lyon, EDAP TMS S.A. was founded in 1989 with a clear mission to develop, manufacture, promote, and distribute innovative technologies for urology. From its earliest years, the company positioned itself as a holding company overseeing specialized subsidiaries dedicated to research, development, production, and commercialization of proprietary ultrasound technology. This structure allowed it to focus deeply on medical products intended for the diagnosis and treatment of prostate conditions and other urological diseases, while maintaining operational flexibility across markets in Europe, the United States, and selected international regions.

Over time, EDAP TMS expanded its portfolio around two core technology pillars: high intensity focused ultrasound and extracorporeal shockwave lithotripsy. The company’s HIFU segment develops robotic and image-guided systems designed to ablate prostate tissue with extreme precision, offering a minimally invasive alternative to traditional surgery or radiation for prostate cancer patients. This intensity focused ultrasound HIFU approach reflects years of internal research and collaboration with scientific institutions, including work connected to INSERM, the French public laboratory network, reinforcing the scientific credibility of its ultrasound technology platform.

Alongside its HIFU segment, EDAP TMS built a complementary business in extracorporeal shockwave lithotripsy, addressing urinary tract stones through non-invasive shockwave treatment. By manufacturing and distributing systems that fragment kidney and urinary stones without incisions, the company broadened its urology portfolio and created a more balanced revenue mix. This dual-segment model allowed EDAP TMS to promote and distribute minimally invasive medical devices across multiple urology indications, strengthening relationships with hospitals, clinics, and an extensive network of distribution partners.

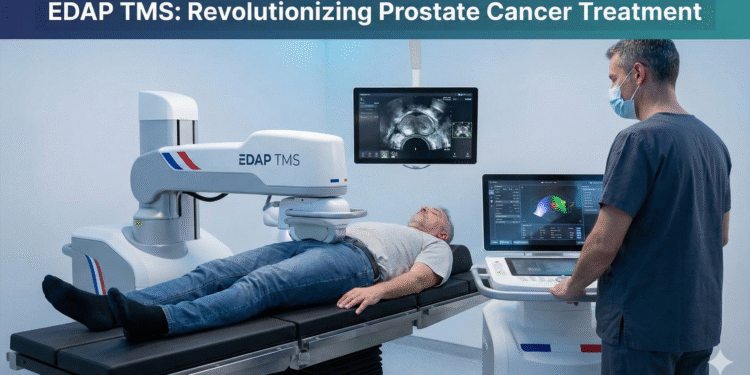

A defining milestone in the company’s background was the development of its flagship robotic HIFU platform, Focal One. Designed specifically for focal therapy in localized prostate cancer, this system integrates proprietary ultrasound, robotic precision, and real-time imaging into a single urology device. Focal One embodies the company’s long-term strategy of moving beyond generic medical devices toward highly specialized, urology-focused technologies intended to improve outcomes while preserving quality of life for patients. The development of this system reflects EDAP TMS’s sustained commitment to innovation, engineering excellence, and clinically driven design.

Throughout its history, EDAP TMS has emphasized regulatory progress as a cornerstone of growth. The company pursued and obtained CE marking in Europe and regulatory clearances in the United States, enabling commercialization of its HIFU and lithotripsy technologies in major healthcare markets. This regulatory groundwork was essential in positioning the company as a credible medical device manufacturer capable of competing within highly regulated environments while expanding its footprint through partnering, distribution, and direct sales.

As a publicly traded company on the Nasdaq, EDAP TMS operates within the global capital markets while maintaining its European research and production roots. Its background reflects a balance between scientific development and commercial execution, as the company manufactures, promotes, and distributes medical devices while continuing to invest in research development and next-generation ultrasound technology. With corporate offices anchored in France and a growing presence in international urology markets, the company’s evolution mirrors broader trends in healthcare toward precision medicine, minimally invasive treatment, and technology-enabled care.

Taken as a whole, the background of EDAP TMS S.A. is defined by long-term focus rather than rapid pivots. From its founding in 1989 to its current role as a specialized urology medical device company, it has remained committed to high intensity focused ultrasound, minimally invasive treatment, and ultrasound-based solutions for prostate cancer and urinary diseases. This continuity of purpose, combined with decades of product development and clinical validation, forms the foundation upon which its current growth strategy and future ambitions continue to build.

EDAP TMS S.A. Emerges as a High-Conviction MedTech Turnaround Story in Minimally Invasive Urology

In a global healthcare market increasingly shaped by minimally invasive medical devices, precision treatment, and technology-driven outcomes, EDAP TMS S.A. (NASDAQ:EDAP) stands out as a deeply specialized medical technology company quietly positioning itself for a long-term inflection point. Founded in France and headquartered in Vaulx-en-Velin, near Lyon, the company has spent decades developing, manufacturing, and promoting proprietary ultrasound technology designed to treat complex urological diseases with reduced trauma, faster recovery, and improved patient outcomes. At a time when prostate cancer incidence continues to rise globally and healthcare systems are prioritizing precision therapies, EDAP TMS S.A. sits at the crossroads of innovation, clinical need, and market transformation.

CHECK THIS OUT: Why Nebius (NBIS) Could Outperform CoreWeave & Dominate the $9B AI Infrastructure Market and Is Lucid Group (LCID) Running Out of Cash? $875M Note Deal Raises Alarms.

A Company Built Around High Intensity Focused Ultrasound and Urology-Based Innovation

EDAP TMS operates as a holding company with subsidiaries focused on the research, development, production, and commercialization of urology-based medical products. Its core strength lies in high intensity focused ultrasound, widely referred to as HIFU technology, which enables targeted tissue ablation without surgical incisions. This intensity focused ultrasound HIFU platform represents a paradigm shift in prostate cancer treatment, offering physicians a robotic HIFU system capable of delivering real-time, image-guided therapy while preserving surrounding healthy tissue.

The company’s flagship Focal One robotic HIFU system exemplifies this approach. Developed to treat localized prostate cancer, Focal One integrates advanced ultrasound, robotic precision, and real-time imaging to deliver focal therapy tailored to each patient’s diagnosis. As prostate cancer treatment increasingly moves toward personalized, organ-preserving approaches, EDAP’s HIFU segment develops solutions aligned with modern clinical practice rather than legacy surgical models.

Beyond Prostate Cancer: A Diversified Portfolio in Urological Diseases

While prostate cancer remains central to EDAP TMS’s growth narrative, the company’s portfolio extends into other critical urological diseases. Through its extracorporeal shockwave lithotripsy business, EDAP addresses urinary tract stones using non-invasive, pulse-based ultrasound energy. This segment targets patients suffering from kidney and urinary stones, conditions that represent a persistent and costly burden for healthcare systems worldwide.

The combination of HIFU and extracorporeal shockwave lithotripsy allows EDAP TMS to maintain diversified exposure within urology, balancing long-term growth investments in prostate cancer treatment with steady demand for stone management solutions. The company manufactures, promotes, and distributes these technologies through an extensive network of distribution partners, reinforcing its global footprint across Europe, the United States, and select international markets.

Scientific Roots and Research Partnerships Strengthen Competitive Position

A critical but often overlooked aspect of EDAP TMS’s background is its deep connection to scientific research. The company has long collaborated with institutions such as INSERM, the French public laboratory dedicated to medical research, helping anchor its technology development in validated clinical science. This research-driven approach has allowed EDAP to refine its ultrasound technology over multiple generations, ensuring that innovation is not merely incremental but clinically meaningful.

Continuous research and development remain central to the company’s strategy. EDAP invests in advancing robotic HIFU, improving treatment accuracy, reducing procedure time, and expanding indications. These efforts are designed to strengthen physician adoption and reinforce the clinical credibility of minimally invasive ultrasound-based therapies.

Financial Performance Signals an Operational Turning Point

Recent EDAP earnings underscore why the company has re-entered investor conversations. In its most recent reported quarter, EDAP TMS delivered revenue of $16.29 million, surpassing analyst expectations of $15.05 million. Earnings per share came in at a loss of $0.15, beating consensus estimates of a $0.26 loss, a meaningful outperformance that suggests improving operational leverage. Despite still posting negative margins, including a reported net margin of negative 30.95% and return on equity of negative 61.60%, the earnings beat highlights tangible progress in execution.

For the current fiscal year, analysts expect EDAP TMS to post approximately negative $0.60 in earnings per share, reflecting ongoing investment in growth, development, and commercialization. Importantly, the company maintains a conservative balance sheet with a debt-to-equity ratio of just 0.04, a current ratio of 1.41, and a quick ratio of 0.97, providing financial flexibility as it scales.

Market Dynamics, Trading Activity, and Institutional Positioning

EDAP TMS stock trades on the Nasdaq under the ticker EDAP, with a recent market capitalization of approximately $126.2 million. Shares recently climbed 13.6% to $3.38, approaching the upper end of the company’s 52-week range of $1.21 to $3.45. The stock’s fifty-day simple moving average stands at $2.37, while its two-hundred-day average is $2.04, signaling improving technical momentum.

Short interest dynamics add another layer to the investment narrative. As of December 15, short interest jumped 163.4% to 93,243 shares, representing roughly 0.2% of the stock and a days-to-cover ratio of 1.3 days. While elevated short interest often reflects skepticism, the relatively low percentage of shares sold short suggests that bearish positioning remains limited, particularly given the recent price strength.

Institutional ownership stands at approximately 62.74%, signaling growing confidence among professional investors. Banque Transatlantique significantly increased its stake to 730,699 shares, valued at roughly $1.32 million, while hedge funds such as Scoggin Management, Sage Mountain Advisors, and Simplicity Wealth established or expanded positions. This accumulation suggests that long-term investors are positioning ahead of potential inflection points in EDAP’s growth trajectory.

Analyst Sentiment and the Disconnect Between Price and Potential

Wall Street sentiment toward EDAP TMS remains mixed, with a consensus rating of Hold and an average price target of $8.50, more than double the stock’s recent trading level. While some firms maintain cautious views, including a Sell rating from Weiss Ratings and a $2.00 target from Jefferies, the wide dispersion in price targets reflects uncertainty rather than consensus pessimism. Historically, such disconnects often emerge when a company transitions from development-heavy phases toward commercialization and scale.

Why the Long-Term Thesis Remains Bullish

The bullish case for EDAP TMS S.A. ultimately rests on structural healthcare trends rather than short-term earnings volatility. Prostate cancer remains one of the most commonly diagnosed cancers in men worldwide, and demand for minimally invasive treatment options continues to rise. High intensity focused ultrasound offers a compelling alternative to surgery and radiation, and EDAP’s proprietary ultrasound technology, combined with its robotic HIFU system, positions the company as a category specialist rather than a generalist medtech competitor.

As adoption of focal therapy expands, reimbursement pathways mature, and physician familiarity increases, EDAP’s installed base and recurring service revenue have the potential to compound. With committed research, expanding distribution, and a growing installed footprint, EDAP TMS may be approaching a phase where revenue growth begins to outpace fixed costs, driving margin expansion over time.

Final Perspective: A High-Risk, High-Reward MedTech Opportunity

EDAP TMS S.A. represents a classic small-cap medical technology opportunity defined by innovation, specialization, and asymmetric upside. While the company continues to report negative earnings, recent results, institutional accumulation, and strengthening market dynamics suggest that the business is moving closer to operational maturity. For investors willing to tolerate volatility and focus on long-term growth in minimally invasive urology devices, EDAP TMS offers exposure to a proprietary technology platform aligned with the future of prostate cancer treatment and ultrasound-based medicine.

READ ALSO: Above Food (ABVE) to Issue 1.1 Billion New Shares in Merger and Perpetua Resources (PPTA) Soars 171% as U.S. Approves $1.3B Gold-Antimony Mine.