Canadian Solar Inc. (CSIQ) in its second quarter 2024 financial results, highlighted significant strides in solar module shipments and battery energy storage solutions. Canadian Solar posted $1.6 billion in revenue, meeting guidance, as it grows in renewable energy and sets new benchmarks.

Record Solar Module Shipments and Expanding Pipeline

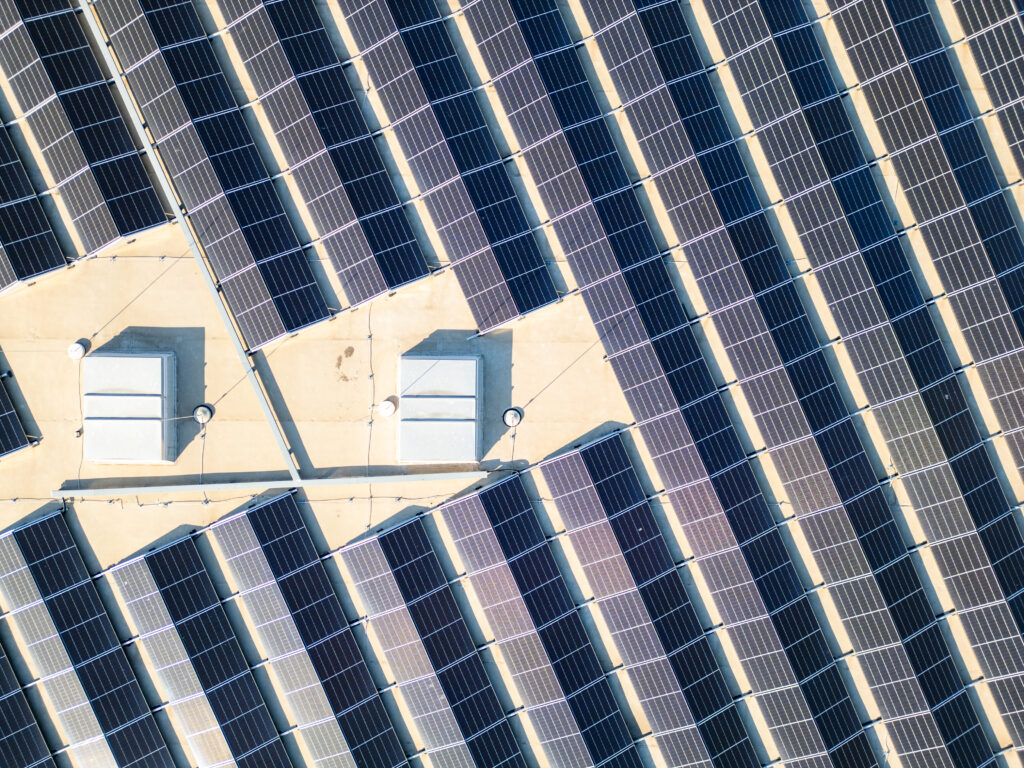

In Q2 2024, Canadian Solar shipped a record 8.2 GW of modules, beating guidance with a 30% increase. This growth stems from robust demand in top markets, including the U.S. and China, as well as strategic investment in capacity expansion.

Recurrent Energy’s solar and battery storage pipeline expanded to 27 GW and 63 GWh, positioning it among top global clean energy developers. Canadian Solar’s Chairman and CEO, Dr. Shawn Qu, emphasized,

“We achieved solid results in Q2, with shipments and revenue aligning with our guidance. We’re committed to scaling competitively while building a resilient platform for long-term growth.”

CHECK THIS OUT: Eli Lilly & Co’s Q3 2024 Results: Revenue Up 42% After New Product Launches

e-STORAGE Business Fuels Record Backlog

Canadian Solar’s e-STORAGE division saw substantial growth in its energy storage backlog, reaching $2.6 billion by the quarter’s end. The 66 GWh project pipeline highlights the company’s commitment to meeting battery storage demand, with key projects in North America and EMEA.

President Yan Zhuang commented on this momentum, stating,

“Despite market challenges, our partial vertical integration allowed us to navigate cost pressures effectively, helping us deliver record volumes in energy storage.”

Financial Highlights and Operational Efficiency

While the company experienced a 3.6% decrease in year-over-year revenue due to reduced module prices and lower project sales, it recorded a net income of $4 million. Gross margin was reported at 17.2%, within guidance, but impacted by competitive pricing pressures.

Increased logistics costs drove total operating expenses higher year-over-year, partially offset by reduced share-based compensation. Canadian Solar optimized its capital structure with a $200 million private placement of convertible notes from PAG, enhancing flexibility.

This, combined with BlackRock’s investment in Recurrent Energy, supports Canadian Solar’s strategy for cash-efficient growth and long-term asset ownership.

Looking Ahead

Canadian Solar projects Q3 revenues between $1.6 billion and $1.8 billion, with anticipated gross margins of 14-16%. Expected module shipments are set to increase to 9.0 GW – 9.5 GW, demonstrating continued growth in core markets.

This strong outlook underscores the company’s resilience in navigating industry dynamics while expanding its renewable energy solutions globally.

With Canadian Solar’s continued focus on sustainability and operational agility, the company remains well-positioned for growth amid the accelerating shift to renewable energy sources.

READ ALSO: PayPal Beats Q3 Forecasts, Lifts Full-Year Outlook on Strong Growth and JetBlue Exceeds Q3 Targets, Boosts Premium Offerings with EvenMore®.