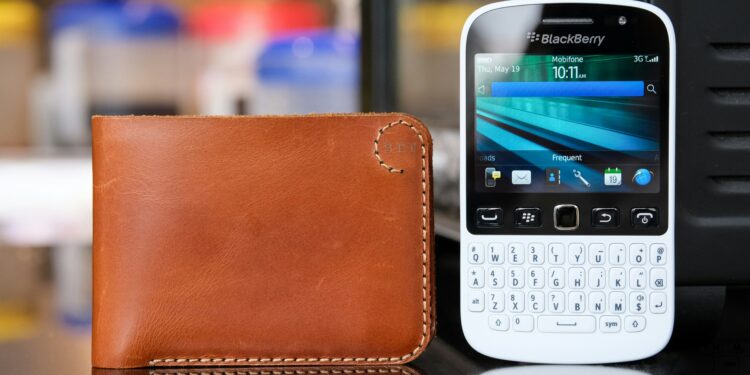

BlackBerry Limited (NYSE:BB), once a global icon in mobile communications, has undergone one of the most remarkable transformations in modern tech history. Founded in 1984 in Waterloo, Ontario, Canada, the company originally operated under the name Research In Motion (RIM) and gained worldwide fame in the 2000s for its BlackBerry smartphones—widely considered the gold standard for enterprise mobility, secure messaging, and business communication. With features like push email and end-to-end encryption, BlackBerry devices were not just popular among corporate executives and government officials—they became cultural and professional status symbols.

As the mobile landscape evolved and competitors like Apple and Android reshaped the smartphone industry, BlackBerry faced mounting pressure to innovate or perish. After a series of attempts to revive its hardware business, the company made a bold and strategic pivot. By 2016, BlackBerry had exited the smartphone manufacturing space entirely, choosing instead to focus its resources on software development, enterprise security, and the Internet of Things (IoT). It rebranded as a software company, signaling a new era built on its core strength: cybersecurity and data protection.

At the heart of BlackBerry’s reinvention is its QNX operating system, an industry-leading real-time embedded OS that powers mission-critical applications in automobiles, medical devices, industrial systems, and more. QNX is now a foundational technology for over 235 million vehicles worldwide, used by leading automakers to run everything from infotainment systems to digital instrument clusters and advanced driver-assistance systems (ADAS). This deep automotive integration has positioned BlackBerry as a key player in the global shift toward software-defined vehicles and electric mobility.

BlackBerry has also reasserted its dominance in cybersecurity through its Secure Communications division. With decades of expertise in secure messaging and encryption, the company now offers solutions for endpoint protection, threat detection, secure communications, and identity access management. These services are trusted by governments, militaries, and major corporations across the globe. By focusing on AI-driven threat detection, zero-trust architecture, and compliance-driven protection, BlackBerry has re-emerged as a formidable name in a crowded cybersecurity market.

Today, BlackBerry generates nearly all of its revenue from software and services, operating as a capital-light, high-margin business with a growing recurring revenue base. Its dual focus on embedded systems and cybersecurity gives it exposure to two of the most significant trends in the digital age: the proliferation of connected devices and the escalating importance of securing digital infrastructure. Through strategic acquisitions, disciplined restructuring, and a renewed commitment to innovation, BlackBerry has not only survived but is once again thriving.

Strong Start to Fiscal Year 2026: BlackBerry Returns to Profitability

BlackBerry recently delivered a blowout first quarter for fiscal year 2026 that turned heads across Wall Street. The company reported a net income of $1.9 million, marking a dramatic turnaround from the $41.4 million net loss posted during the same period in the prior year. This marks BlackBerry’s return to profitability, reinforcing investor confidence in the company’s new strategy and execution discipline. While overall revenue for the quarter came in at $121.7 million, representing a modest year-over-year decline of 1.38%, the figure beat analyst expectations and came with a bright full-year outlook.

The market responded decisively. Shares of BlackBerry surged 12.47% on Wednesday, closing at $4.87, capping off a third consecutive day of gains. The rally came on the heels of positive earnings and management’s strong guidance for fiscal 2026. For the full fiscal year, BlackBerry expects to post between $508 million and $538 million in total revenue, with the second quarter guidance alone ranging between $115 million and $125 million. These forward-looking numbers indicate that the company is gaining traction in both core business lines and that its restructuring efforts are now translating into financial performance.

CHECK THIS OUT: POET Technologies (POET) Delivers 1.6T Optical Innovation—Is a Massive Revenue Surge Next? and BigBear.ai (BBAI) is Flying Under the Radar—But Not for Long. Here’s Why Bulls Are Piling In.

QNX Division Driving Embedded Software Growth in Automotive

The QNX division remains one of BlackBerry’s most valuable assets and a key pillar of its bullish thesis. Used by 45 out of the top 50 automakers globally, QNX powers the infotainment and control systems in over 235 million vehicles on the road today. As vehicles become more software-defined and reliant on real-time data, QNX’s real-time operating system becomes increasingly integral to the automotive supply chain. From electric vehicles to autonomous driving systems, BlackBerry’s embedded solutions are critical in providing the reliability, security, and performance required by Tier 1 manufacturers.

In Q1 FY2026, QNX generated $57.5 million in revenue, driven by increased adoption in electric and software-defined vehicles. With OEMs pushing harder into connected car ecosystems and safety-critical features, BlackBerry stands to benefit from longer-term licensing agreements, embedded royalty deals, and joint development projects that provide recurring revenue. Analysts have noted that QNX gives BlackBerry a strong foothold in a $100+ billion global automotive software market that is still in its early innings of digitization.

Secure Communications Gaining Momentum in Cybersecurity Market

BlackBerry’s Secure Communications division is another vital growth driver. This segment delivers encrypted communications, endpoint protection, and data loss prevention services tailored for government agencies, military units, and enterprises with high security requirements. During the latest quarter, this division beat expectations both on top-line performance and profitability. The full-year revenue outlook for Secure Communications has been raised to between $234 million and $244 million, reflecting strong customer demand and increased government contract wins.

This business benefits from secular tailwinds as global cyber threats escalate and regulatory environments demand stricter compliance. In a landscape where data protection and threat response are mission-critical, BlackBerry’s long legacy in secure mobile infrastructure gives it a competitive edge. The company has doubled down on its zero-trust framework, endpoint security, and AI-driven threat detection to stay ahead of evolving threats and provide a differentiated value proposition in an increasingly crowded market.

Analyst Optimism and Share Price Momentum Signal Bullish Reversal

Investor sentiment around BlackBerry has been shifting in recent weeks—and for good reason. The company’s return to profitability, better-than-expected guidance, and renewed product traction have triggered a wave of bullish analyst coverage. The average 12-month price target now stands around $4.60–$5.00, with some firms forecasting even higher valuations if QNX and Secure Communications maintain current momentum. As the stock rallied 12.47% to $4.87 in just a single session, it is clear that traders and institutions are beginning to recognize the turnaround potential.

BlackBerry’s three-day rally is particularly notable as it has occurred despite broader market volatility and skepticism about tech valuations. The consistency of upward movement—combined with strong volume—indicates that investors are accumulating shares in anticipation of continued earnings beats and strategic execution in the quarters ahead.

Financial Discipline and Strategic Focus Unlock Long-Term Value

One of the key strengths of BlackBerry’s current strategy is its capital-light model and improved financial discipline. The company has restructured operations, sold off underperforming assets, and shifted resources toward its most scalable divisions. The divestiture of Cylance AI—once a drag on margins and capital investment—is a testament to management’s renewed focus on profitability and operational efficiency. With a leaner cost structure, BlackBerry is now free to allocate capital more intelligently into growth areas like IoT, QNX, and secure cloud offerings.

This realignment not only reduces execution risk but also strengthens the company’s ability to generate sustainable free cash flow. In today’s market environment where profitability and discipline matter more than hypergrowth alone, BlackBerry’s balanced approach sets it apart from many of its unprofitable peers in the cybersecurity and software landscape.

Undervalued Stock with Massive Upside Potential

Despite the recent rally, BlackBerry remains deeply undervalued compared to its peers. At under $5 per share, the company trades at a steep discount relative to competitors in both the cybersecurity and automotive software sectors. Yet, its revenue guidance, improving margins, and strategic relevance suggest that a re-rating is long overdue. If management can continue executing on its roadmap and beat forward guidance, there’s a strong case for shares to move toward the $6–$7 range over the next 6–12 months.

Retail investors are also starting to pay attention. According to platforms like StockTwits and Reddit’s r/stocks, bullish sentiment around BlackBerry has grown significantly following the Q1 report. As short interest declines and institutional support strengthens, a combination of technical and fundamental catalysts may set the stage for a broader breakout.

Conclusion: A Modern Tech Comeback Story in the Making

BlackBerry Limited is no longer a relic of the mobile phone era—it is a focused, innovative, and increasingly profitable software company operating in two of the most promising sectors in tech. With embedded software for the automotive future and secure communications for today’s cyber-threat landscape, BlackBerry is uniquely positioned to deliver long-term shareholder value. Its recent earnings beat, improved guidance, return to profitability, and market momentum all point to one conclusion: this is a turnaround that is working.

For investors seeking exposure to the convergence of cybersecurity, IoT, and embedded systems, BlackBerry offers a compelling risk-reward profile. At current levels, it represents a rare opportunity to invest in a globally recognized brand undergoing a high-potential tech renaissance—just as the market begins to take notice.

READ ALSO: MicroVision (MVIS): A Top Pick in Autonomous Tech Stocks and Innoviz (INVZ) May Be Severely Undervalued — Investors Shouldn’t Ignore This Stock.