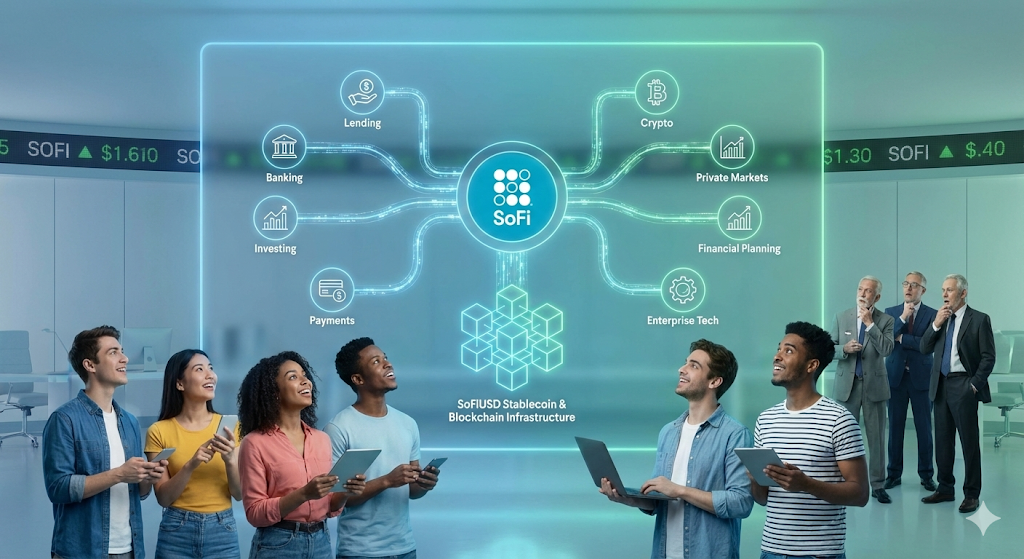

It began as a simple idea to modernize how people borrow, save, invest, and manage their money in an era when most financial institutions were still deeply tied to branch-based operations, legacy systems, and fragmented customer experiences. The original vision was not to create just another financial product, but to build a fully digital financial services platform that could integrate lending, banking, investing, payments, and financial planning into a single mobile-first ecosystem. From the beginning, the mission centered on removing friction from financial life, lowering costs through technology, and empowering users with tools that offered transparency, control, and long-term financial health rather than dependence on traditional intermediaries.

SoFi Technologies Inc. (NASDAQ:SOFI) was founded in 2011 by a group of Stanford Graduate School of Business students and early technology entrepreneurs who believed that financial services could be rebuilt around software, data, and user experience. The company initially focused on student loan refinancing, targeting a segment of high-earning, financially responsible borrowers who were underserved by rigid legacy banking products. This early focus allowed SoFi Technologies Inc. to establish strong credit performance, build a loyal member base, and develop underwriting models rooted in data science and behavioral analytics rather than purely traditional credit metrics.

As the platform matured, SoFi Technologies Inc. rapidly expanded beyond student loans into personal loans, home loans, credit cards, checking and savings accounts, investing, robo-advisory services, insurance referrals, and personal financial management tools. This evolution marked a fundamental shift from being a lender to becoming a vertically integrated fintech and digital bank. The goal was not merely diversification, but the creation of a holistic financial ecosystem where each product strengthened the value of the others and increased customer lifetime value across the platform.

The company’s transformation accelerated following its acquisition of Galileo, a financial technology infrastructure provider that supplies APIs and core banking services to fintech companies worldwide. This acquisition positioned SoFi Technologies Inc. not only as a consumer-facing financial brand but also as an enterprise fintech infrastructure provider, monetizing its technology stack across the broader financial services industry. This dual model gave the company a unique competitive advantage by allowing it to capture value both from end users and from other fintechs building on its platform.

A defining milestone came with the acquisition of a national bank charter through the purchase of Golden Pacific Bancorp, enabling SoFi Technologies Inc. to operate as a regulated digital bank. This allowed the company to accept deposits, lower its cost of funds, gain more control over its lending economics, and expand margins while maintaining regulatory compliance. The bank charter represented a strategic shift that integrated traditional banking stability with fintech innovation, bridging the gap between regulated finance and digital-first user experience.

Headquartered in San Francisco, California and incorporated in Delaware, SoFi Technologies Inc. operates in the center of global financial and technological innovation. Its location, talent base, and product culture reflect the convergence of Silicon Valley software engineering with financial services expertise. The company has consistently emphasized mobile banking, real-time financial insights, automation, artificial intelligence, and data-driven personalization as core elements of its platform.

The brand itself has evolved into a symbol of next-generation finance, appealing particularly to younger, digitally native consumers seeking alternatives to traditional banks. SoFi Technologies Inc. has positioned itself as a financial partner rather than just a service provider, emphasizing education, financial literacy, community, and long-term wealth building through integrated financial tools.

Over time, SoFi Technologies Inc. has expanded into blockchain-enabled finance, payments innovation, and alternative investment access, reflecting its broader ambition to serve as a gateway to both traditional and emerging financial markets. Its launch of stablecoin products, real-time payments infrastructure, and access to private market investments demonstrates its commitment to staying at the forefront of financial innovation while operating within regulated frameworks.

The long-term vision remains consistent with its founding principles: to build a technology-driven, customer-centric financial services platform that replaces fragmented financial relationships with a single, coherent, data-powered financial ecosystem. This vision continues to guide SoFi Technologies Inc. as it expands globally, introduces new financial products, and integrates new technologies into the everyday financial lives of its members.

In this context, SoFi Technologies Inc. is not merely a fintech company, a bank, or a technology provider. It represents a structural reimagining of financial services for the digital age, where software, data, regulation, and consumer experience are fused into a single platform designed to evolve with changing financial behavior and technological progress.

SoFi Technologies, Inc. represents one of the most ambitious attempts of the past decade to rebuild consumer finance from the ground up as a fully digital, vertically integrated, technology-driven financial services platform. Long before traditional banks began seriously modernizing their infrastructure, the company envisioned a future where lending, banking, investing, payments, and financial planning would exist inside a single seamless digital ecosystem that places the customer, not the institution, at the center of the financial experience. That foundational idea continues to shape everything SoFi does today, from its rapid product launches to its aggressive infrastructure investments and its willingness to operate simultaneously as a bank, a technology platform, and a consumer finance brand.

What makes SoFi uniquely compelling in the current market environment is not just growth, but the quality and durability of that growth. The company is no longer simply expanding its top line. It is building an integrated financial ecosystem where customer lifetime value increases over time, margins expand through technology leverage, and cross-selling transforms single-product users into multi-product members embedded across SoFi’s platform.

CHECK THIS OUT: Why Nebius (NBIS) Could Outperform CoreWeave & Dominate the $9B AI Infrastructure Market and Is Lucid Group (LCID) Running Out of Cash? $875M Note Deal Raises Alarms.

The Strategic Importance of the Recent $1.5 Billion Capital Raise

The recent announcement that SoFi completed the sale of 57,754,660 shares of common stock at a public offering price of $27.50 per share is not a red flag for long-term investors but rather a strategic acceleration move. Capital raises at scale are not inherently dilutive if the capital is deployed into projects that generate returns well above the company’s cost of capital. In SoFi’s case, this $1.5 billion public offering strengthens the balance sheet at a time when the company is expanding across multiple high-growth financial verticals, investing in regulated banking infrastructure, scaling new financial products, and positioning itself as a leader in blockchain-enabled finance.

The underwriters exercising their full 30-day option to purchase additional shares is itself a signal of strong institutional demand and confidence in the pricing and market appetite for SoFi stock at this level. This capital allows SoFi to fund growth internally without sacrificing strategic flexibility, while also ensuring regulatory capital strength at SoFi Bank as deposits, lending, and digital asset activity expand.

Crucially, this raise is happening not in desperation, but from a position of operational momentum, increasing revenue, rising profitability, and expanding product breadth.

SoFi’s Evolution into a Full-Spectrum Digital Bank

SoFi is no longer simply a fintech layered on top of traditional banking infrastructure. Through its national bank charter and ownership of SoFi Bank, the company now controls its own deposit base, lending engine, payment rails, and compliance infrastructure. This vertically integrated structure allows SoFi to lower its cost of funds, improve lending margins, manage credit risk internally, and launch new products at a pace traditional banks cannot match.

The launch of SoFiUSD, a stablecoin issued directly by SoFi Bank and backed 1:1 by cash reserves, is a landmark moment not just for SoFi but for the broader financial system. SoFi became the first national bank to issue a stablecoin on a public blockchain, positioning itself at the forefront of regulated digital finance. This is not a speculative crypto play. It is an infrastructure move that integrates blockchain settlement speed into a regulated banking framework, enabling instant redemption, real-time payments, and programmable finance without sacrificing regulatory oversight or consumer protection.

This positions SoFi at the intersection of traditional finance and digital finance, where future growth is likely to be concentrated.

Product Innovation as a Growth Engine

SoFi’s product cadence remains one of the fastest in the financial services sector. The launch of the SoFi Smart Card with 5 percent cash back on groceries and high APY on savings for the first six months is emblematic of the company’s strategy to use attractive consumer incentives not merely to acquire users, but to integrate them deeper into its ecosystem.

Similarly, partnerships with platforms like Templum to offer accredited investors access to private equity opportunities such as Epic Games, Stripe, and previously SpaceX demonstrate how SoFi is expanding beyond traditional retail finance into alternative investments and private markets. This diversification strengthens SoFi’s position as a platform that serves both mass-market consumers and high-net-worth or accredited investors, expanding its total addressable market significantly.

These offerings are not standalone features. They increase user engagement, boost cross-selling, raise switching costs, and reinforce SoFi’s brand as a modern financial super-app rather than a narrow financial product provider.

The Power of the SoFi Ecosystem and Member Growth

The real compounding engine of SoFi is its member base. Each new member is not just a one-time revenue event but a potential multi-product, multi-year relationship. SoFi’s ability to convert users from one product into several is steadily improving, increasing revenue per member and improving long-term profitability.

This is the same dynamic that powered the rise of companies like Amazon and Apple. The more integrated the ecosystem becomes, the more valuable each new user becomes, and the harder it becomes for competitors to displace SoFi from the customer relationship.

Over time, this ecosystem effect creates structural advantages that are extremely difficult to replicate, especially for traditional banks burdened by legacy systems and fragmented product silos.

SoFi’s Positioning Within the Future of Financial Services

SoFi is not competing on price alone, nor on convenience alone, nor on branding alone. It is competing on architecture. Its cloud-native infrastructure, API-driven banking platforms, and data-centric design give it the ability to continuously adapt as financial behavior shifts toward digital, mobile, and real-time.

As younger generations increasingly reject traditional branch-based banking in favor of mobile finance, SoFi stands as a native digital institution built specifically for this shift. Meanwhile, as enterprises and fintechs demand modern banking infrastructure, Galileo and Technisys provide SoFi with a business-to-business growth engine that monetizes its technology beyond its own consumer base.

This dual consumer and enterprise model gives SoFi multiple growth levers operating simultaneously, making its business model far more resilient than single-product fintech companies.

Long-Term Bullish Thesis

The bullish case for SoFi Technologies Inc. rests on the convergence of several powerful trends. Digital banking adoption continues to rise. Consumer finance is shifting toward integrated platforms. Blockchain and real-time payments are moving into regulated frameworks. Private market investing is becoming more accessible. Data-driven personalization is redefining financial services.

SoFi is not reacting to these trends. It is actively building the infrastructure that enables them.

The recent capital raise strengthens SoFi’s ability to execute on this vision without constraint. The launch of SoFiUSD places the company at the frontier of regulated digital assets. The expansion into alternative investments broadens its revenue base. The rapid product innovation cycle keeps its platform relevant and competitive. The growing member ecosystem compounds value over time.

In that context, SoFi is not merely a fintech stock. It is a long-term platform bet on the future architecture of finance itself.

For investors with a long time horizon, the opportunity is not just to own a company growing earnings or revenue, but to own a company shaping how money moves, how people invest, how credit is accessed, and how financial relationships are structured in the digital age.

That is why SoFi Technologies Inc. represents one of the most compelling long-term bullish narratives in modern financial markets.

READ ALSO: Above Food (ABVE) to Issue 1.1 Billion New Shares in Merger and Perpetua Resources (PPTA) Soars 171% as U.S. Approves $1.3B Gold-Antimony Mine.