At a time when photonics was becoming central to computing, manufacturing, and communications infrastructure, a technology-driven enterprise began shaping its identity around the precise control of light. The challenge was not merely to generate photons, but to engineer, amplify, and direct them in ways that could power industrial processes, enable optical communications, and support increasingly complex electronics systems. This focus on light as a fundamental building block laid the groundwork for a company whose technologies now sit at the core of lasers, optics, engineered materials, and advanced manufacturing.

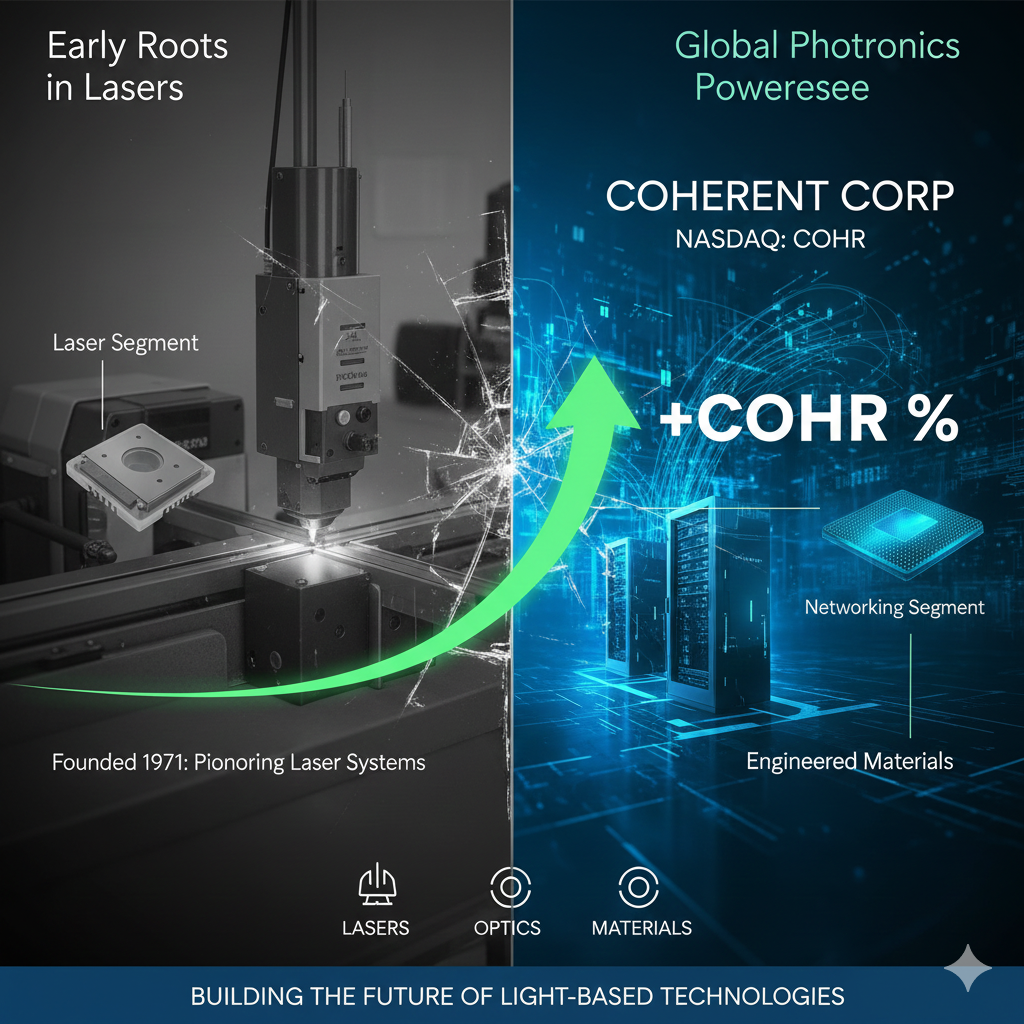

Coherent Corporation (NYSE:COHR) emerged as a global photonics and engineered materials company following the strategic combination with II-VI Incorporated, an integration that significantly expanded its scale, capabilities, and addressable markets. Headquartered in California, Coherent develops, manufactures, and services laser systems, optoelectronic components, subsystems, and materials used across industrial, communications, electronics, and instrumentation markets worldwide. The integration of II-VI strengthened the company’s presence in semiconductor devices, compound semiconductors, thermoelectric components, and advanced ceramic and metal matrix composite materials, positioning Coherent as one of the most vertically integrated players in the photonics industry.

The company operates across three segments that reflect its broad technology base: networking, lasers, and materials. Coherent’s networking segment focuses on optical communications technologies that support datacenter and communications applications, including transceivers, pump lasers, edge emitting laser devices, laser optics, and related modules. These components play a critical role in moving massive volumes of data through fiber-optic networks, where speed, signal integrity, and power efficiency are essential. As data traffic grows due to cloud computing and artificial intelligence workloads, the physics of optical transmission becomes increasingly important, requiring precise control of wavelength, modulation, and thermal performance.

In the laser segment, Coherent designs and manufactures industrial lasers, high power lasers, solid state lasers, and excimer lasers used in precision manufacturing, materials processing, and display manufacturing. These laser systems are deployed in various industrial applications ranging from cutting and welding to micromachining and semiconductor capital equipment. The science behind these systems involves stimulating light emission in controlled media, managing beam quality, and delivering consistent power output to achieve high yield and repeatable performance. Coherent’s ability to integrate laser sources with optics, lenses, and control electronics allows it to serve demanding industrial markets where precision and reliability directly impact production efficiency.

The materials segment extends Coherent’s reach into engineered materials that underpin next-generation electronics and power systems. This includes silicon carbide substrates, advanced ceramic materials, and metal matrix composite materials used in electronics and instrumentation markets. These materials are critical for managing heat, power density, and mechanical stability in semiconductor devices and integrated circuit applications. By controlling the material science layer, Coherent is able to influence the performance and longevity of the systems built on top of them, reinforcing its role as a supplier of foundational technologies rather than standalone components.

Coherent’s background is also shaped by its global footprint and operational infrastructure. The company supports instrumentation markets worldwide through a direct sales force and distribution facilities that serve customers across industrial, communications, scientific research, and electronics sectors. Its technologies are used in industrial communications electronics, networking systems, scientific instrumentation, and advanced manufacturing environments, reflecting a portfolio that spans systems, components, and modules rather than isolated products.

Over time, Coherent has positioned itself as a market innovator by investing in breakthrough technologies that improve power efficiency, performance, and scalability. Whether applied to optical communications in data centers, laser machines used in precision manufacturing, or materials engineered for high-performance electronics, the company’s approach has centered on integrating physics, materials science, and manufacturing expertise. This integrated model allows Coherent to manage costs, improve yield, and accelerate innovation cycles across its product lines.

Today, Coherent Corp stands as a company whose background reflects decades of development in photonics and engineered materials. Its evolution from a laser-focused enterprise into a diversified technology platform mirrors the growing importance of light-based systems in the modern economy. As demand continues to expand across industrial, communications, and electronics markets, the company’s foundation in lasers, optics, materials, and subsystems provides context for its role in shaping the future of high-performance technologies.

Coherent Corp Shares Slide as Supply Concerns Overshadow Strong Photonics Fundamentals

Coherent Corp, a global photonics and engineered materials company, saw its stock come under pressure during Friday’s session as short-term supply dynamics and broader risk-off sentiment in technology markets weighed on shares. As of midday U.S. trading, Coherent stock was changing hands around $180.78, down roughly 8.9 percent from the prior close, after opening near $195.00 and trading within a wide intraday range of approximately $176.74 to $198.60. Trading volume reached about 4.53 million shares, materially above recent daily averages, signaling heightened investor activity.

The selloff occurred despite no change to Coherent Corp’s underlying business performance, which continues to be supported by demand across datacenter and communications applications, semiconductor capital equipment, and industrial laser systems.

CHECK THIS OUT: Why Nebius (NBIS) Could Outperform CoreWeave & Dominate the $9B AI Infrastructure Market and Is Lucid Group (LCID) Running Out of Cash? $875M Note Deal Raises Alarms.

A Photonics Company Built on II-VI’s Engineered Materials Legacy

Coherent Corp traces its modern structure to the combination with II-VI Incorporated, creating one of the world’s most vertically integrated photonics and laser technology companies. Headquartered in California, the company manufactures and develops lasers, optics, subsystems, and engineered materials used across industrial, communications, electronics, and instrumentation markets worldwide.

Through the II-VI platform, Coherent operates across three segments: the Networking segment, the Laser segment, and the Materials segment. This structure allows the company to harness photons as a fundamental building block across a wide range of precision manufacturing and communications applications. The integration of II-VI expanded Coherent’s footprint into compound semiconductors, optoelectronic components, thermoelectric components, and advanced ceramic and metal matrix composite materials.

Networking Segment Anchored by Optical Communications and Datacenter Demand

The Networking segment offers transceivers, laser optics, pump lasers, and edge-emitting laser technologies used in optical communications and communications electronics and instrumentation. These products are critical to modern datacenter and communications applications, where bandwidth requirements are rising sharply due to artificial intelligence workloads and cloud computing expansion.

In its most recent quarterly report, Coherent disclosed that datacenter-related demand was a key contributor to revenue performance. For the quarter ended September 30, 2025, the company reported total revenue of $1.58 billion, with optical communications and networking applications cited as a primary growth driver. As data centers transition toward higher-speed interconnects, Coherent’s networking segment benefits from both volume growth and higher performance requirements, which support margin expansion.

Laser Segment Serves Industrial and Precision Manufacturing Markets

The Laser segment includes industrial lasers, high power lasers, solid state lasers, excimer lasers, and laser machines used in materials processing, display manufacturing, and various industrial applications. These laser systems are deployed in precision manufacturing environments, including semiconductor fabrication, integrated circuit processing, and advanced display manufacturing.

Coherent’s laser systems are used in applications requiring high yield, power efficiency, and performance stability. Industrial markets continue to rely on these technologies for cutting, welding, and precision shaping, while electronics and instrumentation markets use lasers for micro-processing and scientific research. The company’s ability to manufacture both laser sources and supporting optics and lenses provides a competitive advantage in controlling costs and performance consistency.

Materials Segment Expands Exposure to Engineered Materials and Semiconductor Devices

The Materials segment represents a differentiator for Coherent Corp within the photonics industry. This segment focuses on engineered materials, including silicon carbide, advanced ceramic substrates, and metal matrix composite materials. These materials are used in semiconductor devices, power electronics, and electronics and instrumentation markets where thermal management and power efficiency are critical.

On December 3, 2025, Coherent announced progress on its next-generation 300mm silicon carbide platform, building on its existing 200mm capabilities. The company positioned this development as a response to rising power and thermal demands in datacenter infrastructure and communications electronics. Silicon carbide substrates are increasingly viewed as foundational technologies for high-performance power systems, expanding Coherent’s addressable market beyond lasers and optics.

Financial Performance Shows Margin Stability and Balance Sheet Progress

In its fiscal first-quarter 2026 earnings release, Coherent reported GAAP gross margin of 36.6 percent and non-GAAP gross margin of 38.7 percent. GAAP earnings per share came in at $1.19, while non-GAAP EPS was reported at $1.16. Management also disclosed approximately $400 million in debt paydown and refinancing actions aimed at reducing interest expense, strengthening the balance sheet following the II-VI integration.

These figures have underpinned a series of upward price target revisions from sell-side analysts. In early December, JPMorgan raised its price target on Coherent to $215 from $180, while Raymond James lifted its target to $210 from $180, citing improving visibility in optical communications and semiconductor capital equipment demand.

Market Reaction Driven by Supply Mechanics, Not Business Deterioration

The immediate catalyst for Friday’s stock move was a Form 144 filing tied to a Bain Capital–affiliated holder, signaling intent to sell up to 5 million shares with an aggregate market value of approximately $947.75 million. While such filings do not guarantee execution, they can influence near-term trading by introducing supply overhang concerns, particularly when combined with broader weakness in AI-linked equities.

At the same time, macro sentiment shifted after concerns around AI spending sustainability emerged following commentary from other technology companies. When AI-related trades de-risk, mid-cap infrastructure suppliers such as Coherent often experience amplified price swings relative to mega-cap peers.

Positioning Within a Global Photonics Industry

Despite short-term volatility, Coherent remains one of the world’s market innovators in photonics, serving industrial, communications, and scientific research markets through a direct sales force and global distribution facilities. Its integrated approach across systems, components, modules, and materials allows the company to participate in future technology cycles spanning lasers, optics, electronics, and semiconductor devices.

For investors, the current pullback highlights the tension between near-term trading dynamics and long-term demand for photonics technologies that support datacenters, industrial automation, and next-generation electronics. Whether the stock stabilizes near current levels or resumes its upward trajectory will depend on continued execution, sustained demand growth, and the market’s willingness to look beyond temporary supply pressures.

READ ALSO: Above Food (ABVE) to Issue 1.1 Billion New Shares in Merger and Perpetua Resources (PPTA) Soars 171% as U.S. Approves $1.3B Gold-Antimony Mine.