Celestica Inc. (NYSE:CLS) is a global leader in advanced design, manufacturing, hardware platform solutions, and supply chain services for some of the world’s most complex and high-performance industries. Headquartered in Toronto, Canada, Celestica has evolved far beyond its origins as a manufacturing division of IBM in the 1990s to become one of the most trusted partners for innovation-driven sectors such as artificial intelligence (AI), cloud computing, aerospace and defense, healthcare technology, industrial automation, renewable energy, and next-generation communications infrastructure. With a workforce of over 25,000 employees and operations spanning North America, Europe, and Asia, the company’s mission centers on enabling its clients to design, build, and deliver products that shape the future of technology and digital transformation across the globe.

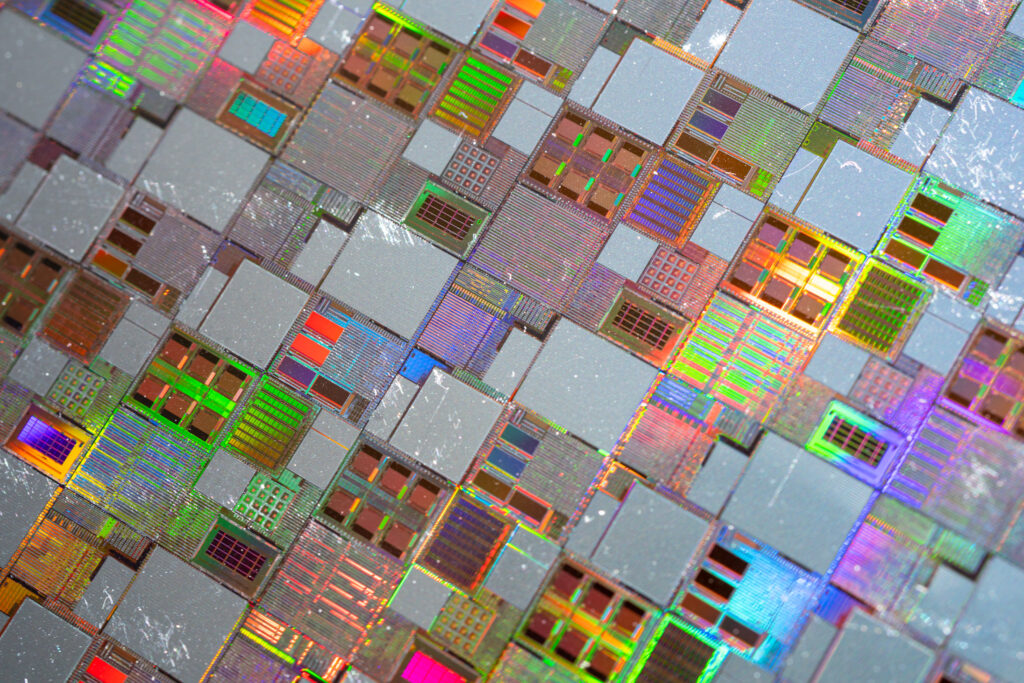

The company’s evolution from a traditional electronics manufacturing services (EMS) provider into a diversified technology solutions powerhouse represents one of the most successful transformations in the sector. Celestica’s early years were defined by its precision manufacturing excellence, supplying major technology brands with high-quality components and system assemblies. However, as global technology needs shifted toward integrated design, complex systems, and hardware acceleration for artificial intelligence and cloud workloads, Celestica strategically repositioned itself to move up the value chain. This transformation involved expanding its capabilities in engineering, design for manufacturability, and high-performance computing platforms. Today, the company is known not only for its manufacturing prowess but also for its end-to-end innovation—spanning concept design, prototyping, system integration, and global logistics management.

A key pillar of Celestica’s strength lies in its Connectivity and Cloud Solutions (CCS) and Advanced Technology Solutions (ATS) divisions. The CCS segment serves the rapidly expanding data center and communications infrastructure markets, providing high-value services to hyperscalers, network equipment providers, and enterprise hardware companies. This division plays a vital role in the global shift toward AI data centers, edge computing, and next-generation networking systems, producing the physical backbone that enables cloud and machine learning applications to thrive. The ATS segment, on the other hand, supports aerospace, healthcare, industrial, and energy sectors with mission-critical technologies that demand reliability, traceability, and regulatory compliance. Together, these divisions provide Celestica with a balanced portfolio that mitigates cyclical risks and positions it for sustainable long-term growth.

ARTICLE HIGHLIGHT: Tony Zhou of Waton Financial (WTF) Unveils “InfoMan” AI Agent at New Fortune Annual Meeting in Guangzhou.

Celestica’s innovation ecosystem extends far beyond traditional contract manufacturing. The company invests heavily in automation, robotics, and AI-enabled manufacturing intelligence to enhance efficiency, precision, and scalability. Its state-of-the-art facilities across the globe are equipped to handle both low-volume, high-mix production for specialized industries and high-volume, high-speed production for large-scale technology deployments. By leveraging digital twins, predictive analytics, and advanced materials engineering, Celestica is able to deliver faster design iterations, reduced time to market, and improved product reliability for its clients—advantages that have made it a preferred partner for industry leaders navigating the complexities of modern supply chains.

The company’s role in the AI and cloud computing revolution cannot be overstated. As hyperscale data centers rapidly expand to meet global demand for generative AI and high-performance computing, Celestica’s expertise in server and network hardware manufacturing has positioned it as a silent backbone of the digital infrastructure economy. From designing AI-optimized server racks and high-density interconnects to integrating advanced optical modules and cooling systems, Celestica provides the physical hardware that powers today’s most advanced computing networks. Its clients include many of the largest cloud service providers, telecommunications firms, and original equipment manufacturers (OEMs) worldwide.

Financially, Celestica has established a strong track record of consistent growth and profitability. The company has achieved record revenues exceeding $12 billion annually, fueled by double-digit expansion in its high-growth segments. Its disciplined balance sheet management—with a low debt-to-equity ratio and robust cash flow generation—provides it with the flexibility to reinvest in automation, research and development, and strategic acquisitions. This financial resilience, combined with operational excellence and customer diversification, has earned Celestica a reputation for reliability among both investors and global partners.

The company’s leadership team, guided by President and CEO Rob Mionis, has been instrumental in driving Celestica’s transformation and long-term strategy. Under Mionis’s tenure, the company has consistently focused on delivering shareholder value through sustainable growth, margin expansion, and innovation leadership. Celestica’s ongoing commitment to sustainability and corporate responsibility further enhances its market standing. It continues to integrate ESG principles across its operations—reducing waste, minimizing carbon emissions, and maintaining ethical sourcing standards throughout its global supply chain network.

Today, Celestica stands at the intersection of manufacturing excellence and technological innovation. It is not merely a supplier but a strategic partner that enables global enterprises to compete in the rapidly evolving digital economy. From the design labs that prototype the future of AI hardware to the assembly lines that produce components for aerospace, medical imaging, and renewable energy systems, Celestica remains a critical enabler of progress across multiple industries. Its ability to combine agility, technical depth, and global scale has transformed it into a key player in the next era of intelligent manufacturing—an era defined by automation, data-driven decision-making, and hardware that fuels the world’s digital transformation.

The Quiet AI Manufacturing Powerhouse Fueling Wall Street’s Next Big Rally

Celestica Inc. (NYSE: CLS) has quietly become one of the most powerful under-the-radar success stories of the 2025 AI and hardware boom. Founded in Toronto and once known primarily as a contract manufacturer, Celestica has evolved into a global leader in advanced design, manufacturing, and supply chain solutions for some of the world’s most demanding technology sectors. The company’s expertise spans communications infrastructure, cloud and data center systems, aerospace, defense, healthcare technology, and industrial automation. But its biggest catalyst now lies in AI-driven hardware, hyperscale data centers, and high-performance computing infrastructure—industries experiencing explosive growth amid the global demand for machine learning acceleration and cloud capacity.

The company’s Q3 2025 performance underscored its transformation into a high-margin, high-growth enterprise. Celestica reported revenue of $3.19 billion, representing a 27.8% year-over-year increase, and an EPS of $1.58, beating analyst estimates of $1.45. Net income surged to $267.8 million, translating to a robust 6.35% net margin and 30.53% return on equity—evidence of exceptional operational execution. The company raised its full-year guidance, projecting continued momentum through 2026 as it rides the wave of global AI infrastructure buildouts and advanced electronics demand.

CHECK THIS OUT: Why Nebius (NBIS) Could Outperform CoreWeave & Dominate the $9B AI Infrastructure Market and Is Lucid Group (LCID) Running Out of Cash? $875M Note Deal Raises Alarms.

Institutional and Insider Confidence Paint a Bullish Picture

One of the strongest bullish indicators for Celestica’s future is the rising tide of institutional and insider confidence. W.H. Cornerstone Investments recently opened a new stake of 1,375 shares valued at approximately $215,000, joining a growing list of institutional investors that view Celestica as a long-term winner in the mid-cap technology space. Meanwhile, Director Laurette T. Koellner, an experienced executive with deep industry insight, demonstrated her personal conviction by purchasing 6,000 shares at an average price of $341.67, a transaction valued at $2.05 million.

Beyond individual insider activity, heavyweight institutional investors are accumulating positions aggressively. Vanguard Group Inc., the largest holder, boosted its stake by 0.8% in Q1 2025, bringing its total to 4.51 million shares valued at $356 million. Voya Investment Management LLC increased its holdings by a staggering 362.8%, now controlling 1.85 million shares worth $146 million. Connor Clark & Lunn Investment Management Ltd. raised its position by 17.6% to 1.73 million shares worth $271 million, while Royal Bank of Canada and Alkeon Capital Management also expanded their exposure significantly. In total, institutional investors and hedge funds now own roughly 67.38% of Celestica’s outstanding shares—a strong sign of confidence in its sustained profitability and long-term strategic direction.

The Fundamentals Behind Celestica’s Meteoric Rise

Celestica’s fundamentals are more than just strong—they’re exceptional for a mid-cap technology stock. As of its latest report, the company’s market capitalization stands at $34.35 billion, with a price-to-earnings (P/E) ratio of 48.61 reflecting investor optimism for future growth. It maintains a debt-to-equity ratio of only 0.37, alongside a healthy current ratio of 1.47 and quick ratio of 0.86, underscoring a strong balance sheet and disciplined financial management.

Technically, Celestica’s stock continues to demonstrate sustained strength. The shares have climbed from a 12-month low of $58.05 to an all-time high of $363.40, marking one of the most impressive rallies among global electronics and manufacturing names. Despite this meteoric rise, analysts maintain bullish sentiment, setting an average price target of approximately $336—a reflection of ongoing upward revisions and expanding valuation potential.

These financial achievements mirror Celestica’s success in expanding its operational footprint into higher-margin verticals such as AI servers, cloud infrastructure, and advanced component integration. Its Connectivity & Cloud Solutions (CCS) segment—now the company’s fastest-growing business unit—has been driving record growth as hyperscalers like Amazon, Microsoft, and Google continue to invest billions into next-generation computing hardware.

Strategic Positioning in the Global AI and Cloud Ecosystem

Celestica’s rise parallels the global explosion of AI infrastructure demand. The company provides the “picks and shovels” for the AI gold rush—manufacturing and integrating the servers, racks, and networking systems that make machine learning and large language model processing possible. As enterprises and governments invest heavily in data center modernization, Celestica’s end-to-end design and production capabilities make it a critical partner in ensuring performance, scalability, and energy efficiency.

By focusing on AI hardware and complex system integration rather than commoditized electronics, Celestica has moved decisively up the value chain. This shift not only boosts gross margins but also strengthens its competitive moat. Its vertically integrated supply chain enables it to deliver customized, high-performance solutions faster than competitors, an advantage increasingly vital in a world where hardware demand is volatile and supply chains remain constrained.

Analysts and Market Sentiment: Strong Buy Territory

Wall Street analysts remain overwhelmingly bullish on Celestica’s growth trajectory. The company’s ability to consistently beat earnings estimates, coupled with its role in the AI hardware ecosystem, has prompted multiple price target upgrades, with projections now clustering around the $330–$340 range. The average rating among covering analysts is a “Strong Buy,” driven by Celestica’s accelerating revenue growth, expanding margins, and improving balance sheet.

Analysts cite Celestica’s expanding market share in cloud and data infrastructure as a key valuation driver. They note that as major clients outsource more high-end design and manufacturing functions, Celestica’s expertise and global footprint position it as an indispensable partner. This trend, coupled with its strong balance sheet and consistent profitability, could justify a valuation multiple expansion similar to leading peers like Jabil (NYSE: JBL) and Flex Ltd. (NASDAQ: FLEX).

Financial Resilience and Shareholder Value Creation

Celestica’s strong liquidity, disciplined capital allocation, and strategic investments suggest it can sustain double-digit growth without compromising profitability. The company continues to reinvest in advanced engineering, automation, and AI-enabled manufacturing processes—key enablers of efficiency and scalability. Meanwhile, its free cash flow growth supports potential future share buybacks or dividend initiation, signaling that shareholder value creation remains a top priority.

The company’s beta of 1.85 indicates strong responsiveness to tech market trends, but its diversified business mix and improving margins provide a hedge against sector volatility. Its growing roster of blue-chip customers, coupled with institutional ownership above 67%, reinforces investor confidence that Celestica’s growth story is far from over.

The Bottom Line: A Long-Term AI Infrastructure Winner

Celestica Inc. has transformed itself into a global high-performance electronics powerhouse, perfectly positioned to capture the tailwinds of AI infrastructure, cloud computing, and next-generation networking demand. With triple-digit share gains over the past year, accelerating institutional investment, consistent earnings beats, and a robust balance sheet, the company has evolved beyond its contract manufacturing roots into a major enabler of the world’s most critical technologies.

The numbers tell the story: $3.19 billion in quarterly revenue, 27.8% annual growth, $267.8 million in net income, 30.53% ROE, and a $34 billion market cap—supported by deep insider and institutional conviction. As data centers expand and AI workloads multiply, Celestica’s growth engine is just getting started. For investors seeking exposure to the backbone of the AI revolution, Celestica (NYSE: CLS) stands as one of the most compelling bullish opportunities in 2025 and beyond.

READ ALSO: Above Food (ABVE) to Issue 1.1 Billion New Shares in Merger and Perpetua Resources (PPTA) Soars 171% as U.S. Approves $1.3B Gold-Antimony Mine.